What Is A Cup And Handle Pattern

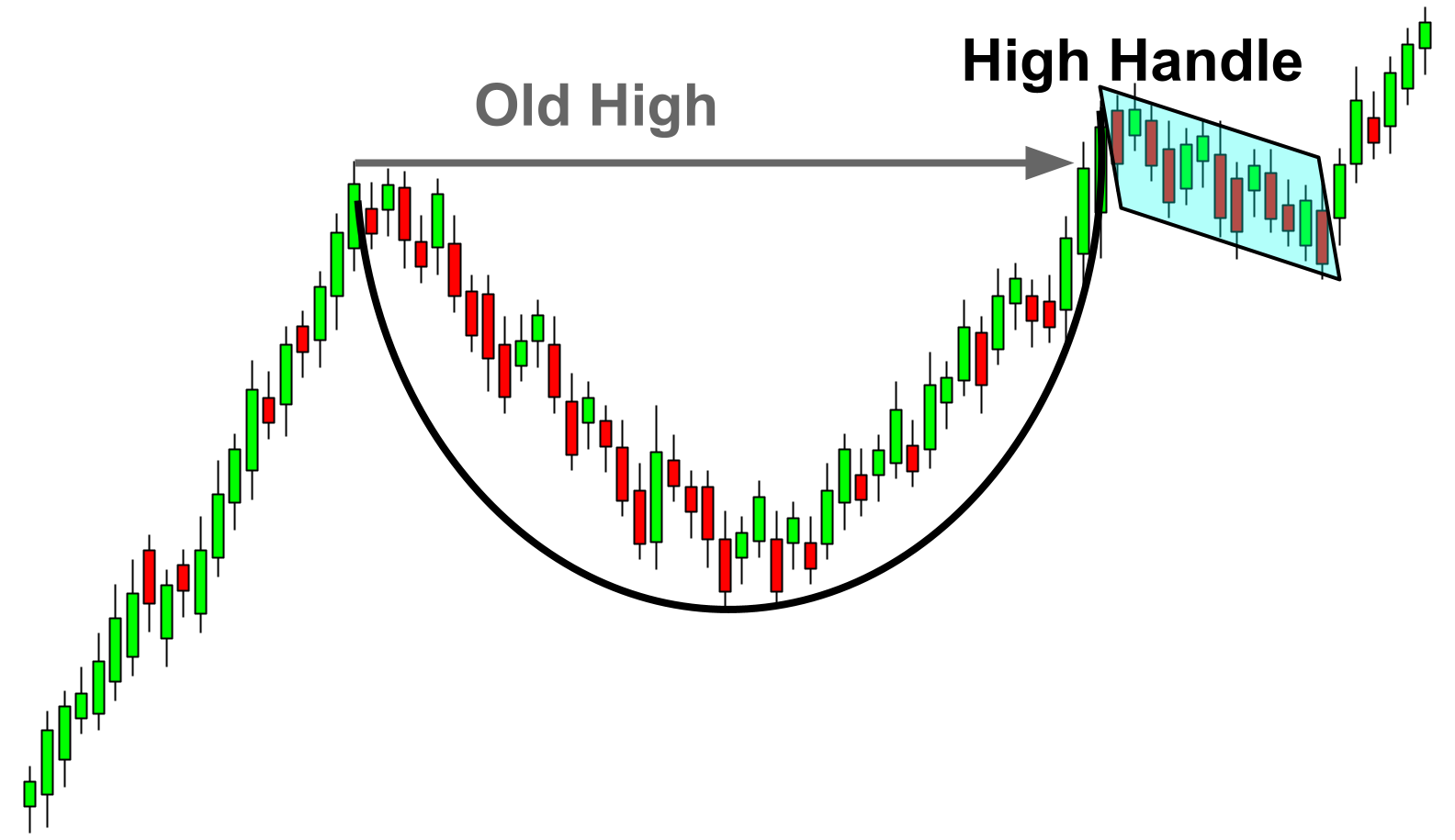

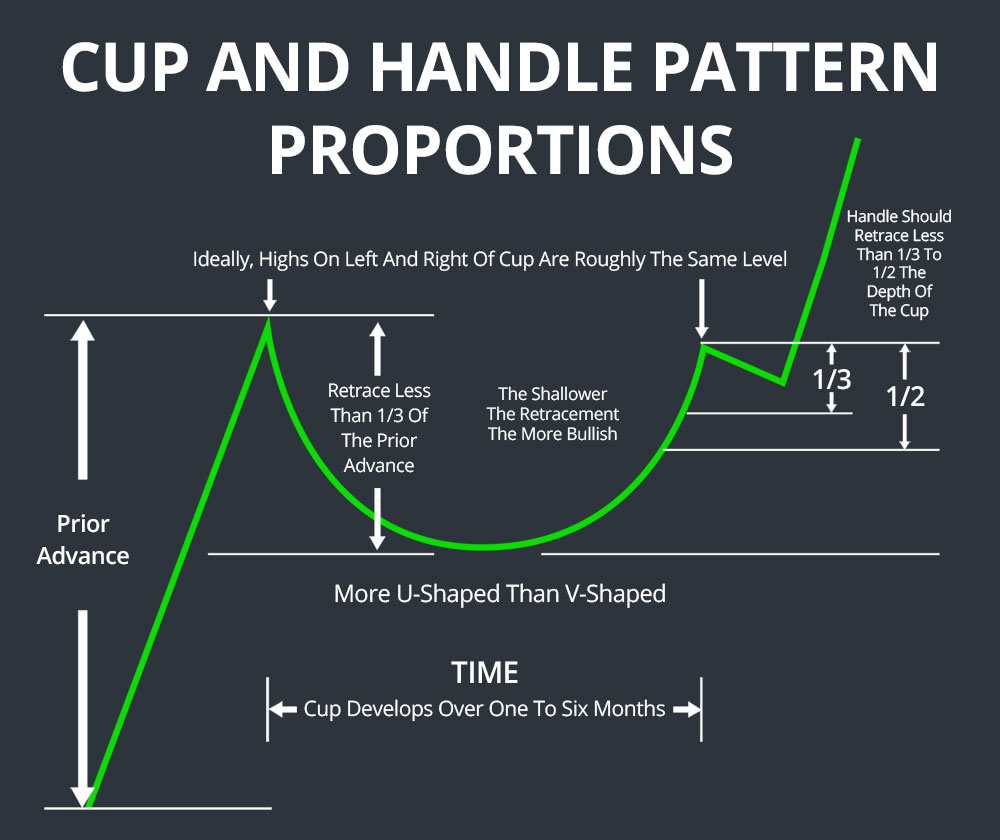

What Is A Cup And Handle Pattern - It occurs when the stock price has been decreasing then follows another rise after the decrease. It looks very much like a cup with a handle. Web the cup and handle pattern is a continuation chart pattern that looks like cup and handle with a defined resistance level at the top of the cup. Web table of contents. As the name suggests, the pattern is made up of two sections; It gets its name from the tea cup shape of the pattern. The cup forms after an advance and looks like a bowl or rounding bottom. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. Web the cup and handle pattern is a bullish continuation pattern that consists of two parts, the cup and the handle. Let's consider the market mechanics of a typical. The cup — the market show signs of bottoming as it has bounced off the lows and is making higher highs towards resistance. Web basic characteristics of the cup with handle. Deconstructing the cup and handle. They normally give multifold returns. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. The cup and handle is an accumulation buying pattern, which is found during long periods of consolidation, and can lead to powerful explosive moves once the pattern is fully completed. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. Learn how it works with an example, how to identify. It is believed that after the breakdown of the handle, the price will go further in the direction of the trend by. Web the cup and handle chart pattern is a technical analysis trading strategy in which the trader attempts to identify a breakout in asset price to profit from a strong uptrend. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. Learn how to trade this pattern to improve your odds of making profitable trades. The cup and handle chart pattern does have a few limitations. What is a cup and handle price pattern? Deconstructing the cup and handle. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. The stock needs to show a 30% uptrend from any price point, but it must be. The cup and handle chart pattern does have a few limitations. The cup and handle is an accumulation buying pattern, which is found during long periods of consolidation, and can lead to powerful explosive moves once the pattern is fully completed. They normally give multifold returns. The pattern starts when a stock’s price runs up, then pulls back to form. It is considered a signal of an uptrend in the stock market and is used to discover opportunities to go long. The cup forms after an advance and looks like a bowl or rounding bottom. Web it is a bullish continuation pattern that resembles a cup with a handle. What is a cup and handle price pattern? The stock needs. Learn how to trade this pattern to improve your odds of making profitable trades. The cup — the market show signs of bottoming as it has bounced off the lows and is making higher highs towards resistance. There are two parts to the pattern: The cup typically takes shape as a pull back and subsequent rise, with the candlesticks in. The cup forms after an advance and looks like a bowl or rounding bottom. It gets its name from the tea cup shape of the pattern. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. Web do you know how to spot a cup and handle pattern on. The cup forms after an advance and looks like a bowl or rounding bottom. Web in the domain of technical analysis of market prices, a cup and handle or cup with handle formation is a chart pattern consisting of a drop in the price and a rise back up to the original value, followed first by a smaller drop and. The cup and handle chart pattern does have a few limitations. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. Deconstructing the cup and handle. Web the cup and handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. There are two parts to the. Web table of contents. Web almost every pattern has its opposite. The cup and handle chart pattern does have a few limitations. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. Deconstructing the cup and handle. Let's consider the market mechanics of a typical. The cup — the market show signs of bottoming as it has bounced off the lows and is making higher highs towards resistance. Web one of the most famous chart patterns when trading stocks is the cup with handle. Web the cup and handle chart pattern is a technical analysis trading strategy. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. Web table of contents. The easiest way to describe it is that it looks like a teacup turned upside down. It is considered a signal of an uptrend in the stock market and is used to discover opportunities to go long. The pattern starts when a stock’s price runs up, then pulls back to form a cup shape. Web a cup and handle pattern, also known as a “cup with handle” pattern, forms when market data is compiled and viewed over time. They normally give multifold returns. The handle — a tight consolidation is formed under resistance. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. Web one of the most famous chart patterns when trading stocks is the cup with handle. The cup typically takes shape as a pull back and subsequent rise, with the candlesticks in the center of the cup giving it the form of a rounded bottom. A cup and handle pattern acts as a consolidation pattern when it forms in an uptrend. Web the cup and handle pattern is a pattern that traders use to identify whether the price of an asset will continue moving upwards. Let's consider the market mechanics of a typical. Web basic characteristics of the cup with handle. There are 2 parts to it:Cup and handle chart pattern How to trade the cup and handle IG UK

Cup and Handle Pattern Trading Strategy Guide Synapse Trading

Cup and Handle Pattern Meaning with Example

Cup and Handle Definition

Cup And Handle Pattern Artinya

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Patterns Comprehensive Stock Trading Guide

How To Trade Blog Cup And Handle Pattern How To Verify And Use

CupAndHandle Pattern Definition Finance Strategists

Cup and Handle Patterns Comprehensive Stock Trading Guide

The Cup And The Handle.

Web A ‘Cup And Handle’ Is A Chart Pattern That Can Help You Predict Future Price Movements.

Learn How To Read This Pattern, What It Means And How To Trade.

As The Name Suggests, The Pattern Is Made Up Of Two Sections;

Related Post:

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)