W Trading Pattern

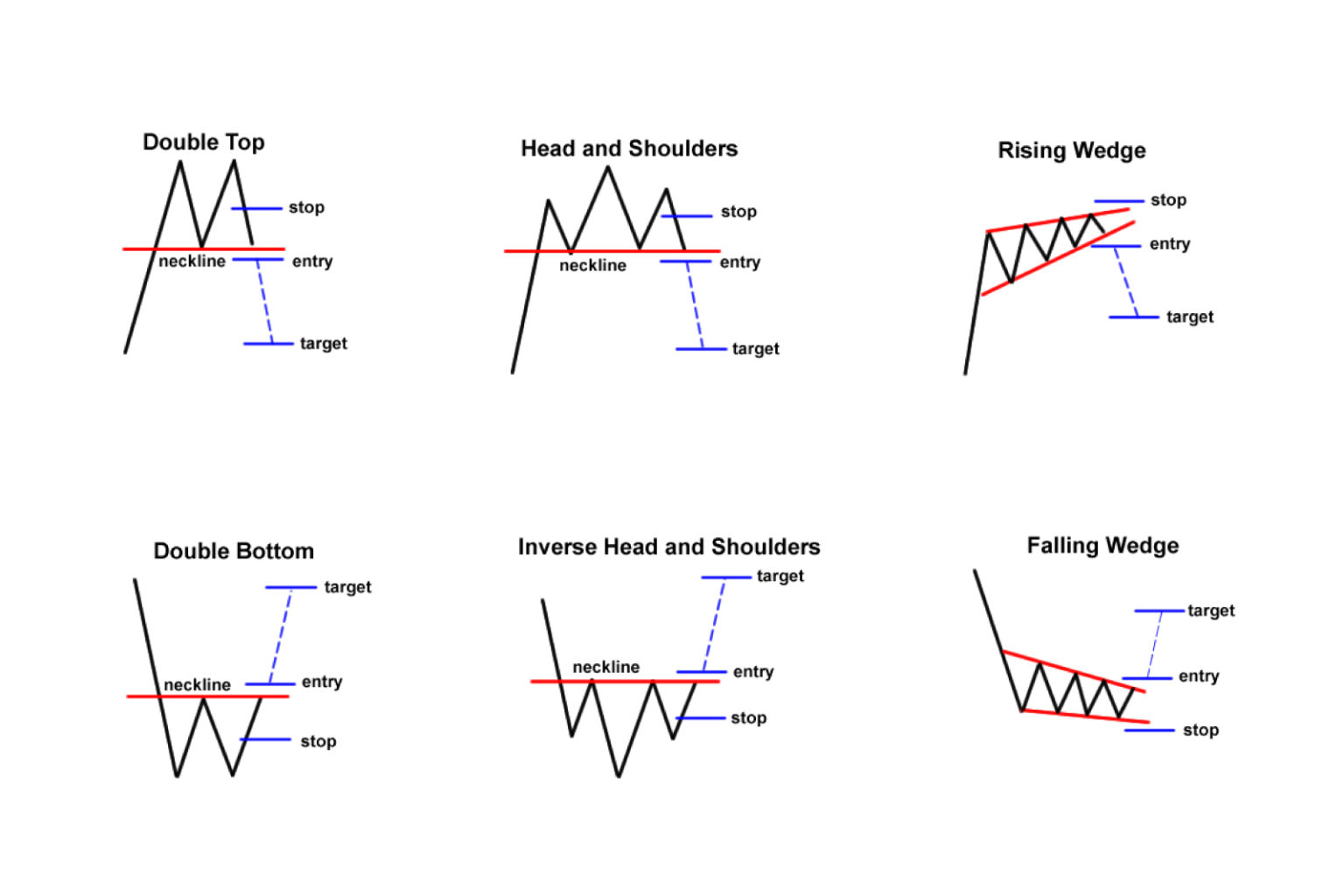

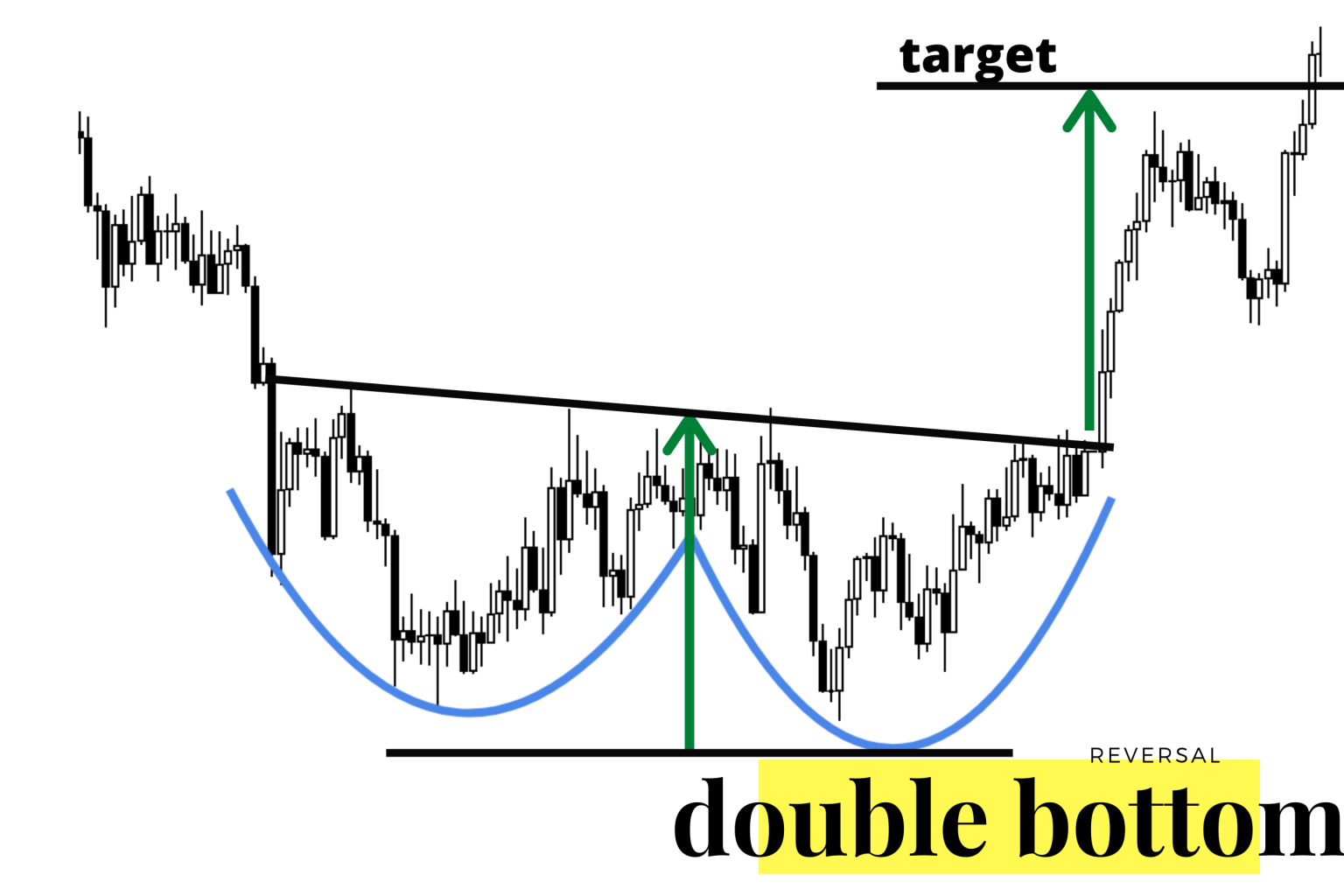

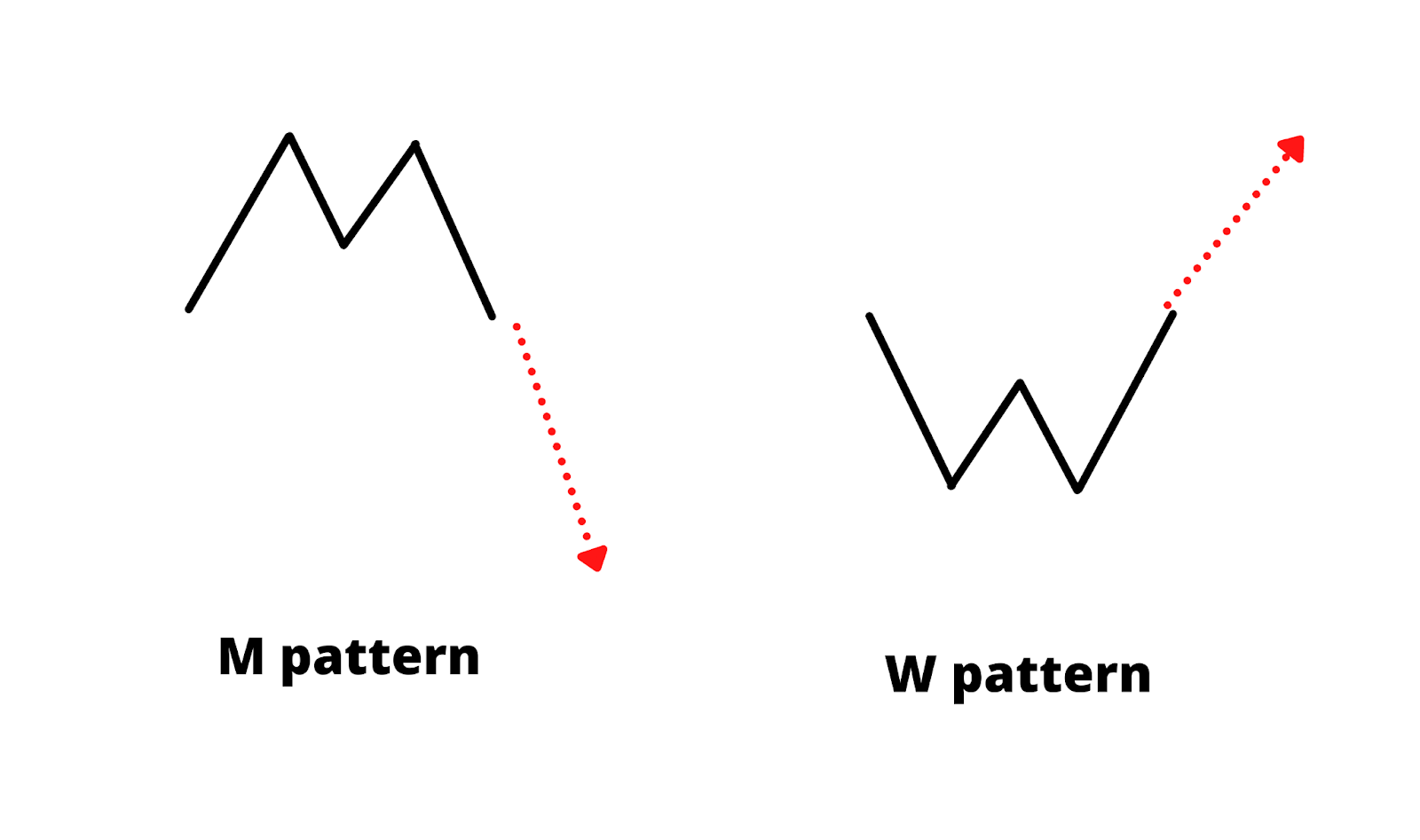

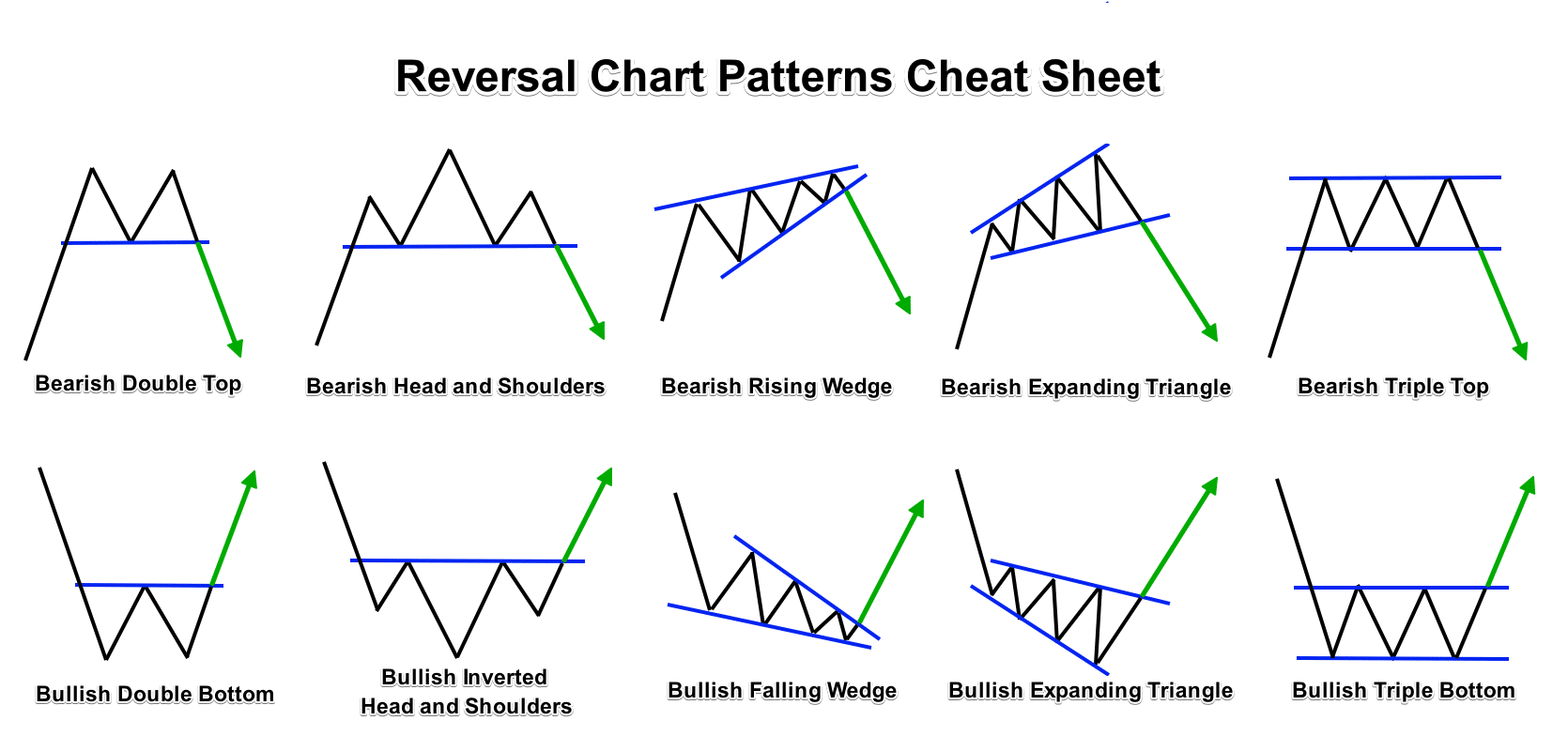

W Trading Pattern - The double bottom pattern occurs when the price of a currency pair reaches a low point, bounces back up, dips again to the same level,. The pattern starts emerging when the prices first jump off after the constant horizontal trend line of an asset. It resembles the letter ‘w’ due to its structure formed by two consecutive price declines and recoveries. Web a w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. The renko charts must be in an uptrend. Web overview of w bottoms and tops chart patterns. Web understanding the fundamentals of w pattern chart in the stock market. The world of trading is filled with patterns and signals that traders use to make informed decisions. A favorite of swing traders, the w pattern can be formed over a. If it is moving from bottom left to. Web one popular pattern that traders often look out for is the double bottom, also known as the w pattern. Web the w pattern is a technical analysis pattern that resembles the letter “w” and is formed by two consecutive troughs followed by a higher peak. The script also calculates the percentage difference between the current low and the previous high, displaying this value on the chart when the pattern is detected. The w pattern is a technical analysis pattern that is formed on the price chart. In this article, we will enter into the w pattern in trading, exploring its formation, significance, and how traders can leverage it to enhance their trading. Web one popular trading strategy that many traders use is the w pattern strategy. Traders may use w bottoms and tops chart patterns as powerful indicators for buying and selling decisions. What is the w pattern? Web the classic w pattern is the most basic form of the double bottom pattern. The renko charts must be in an uptrend. The difference between w pattern and other chart patterns. A favorite of swing traders, the w pattern can be formed over a. Web the w pattern, a technical trading indicator, signals a bullish market reversal. This pattern is highly regarded in the trading community and is used to pinpoint potential buy signals. Importance of w pattern chart in trading strategies. If it is moving from bottom left to. Web the w pattern is typically found in downtrends, indicating that the bears are losing control and the bulls are starting to regain dominance. What is the w pattern? Web what is a w pattern? Traders look for a significant increase in trading volume during the formation of the second low, indicating. A favorite of swing traders, the w pattern can be formed over a. The world of trading is filled with patterns and signals that traders use to make informed decisions. It resembles the letter ‘w’ due to its structure formed by two consecutive price declines and recoveries. In this article, we will explore what the w pattern is, how to. Web the w trading pattern is a reversal pattern used to identify changes in market trends. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). This pattern is highly regarded in the trading community and is used to pinpoint. Traders look for a significant increase in trading volume during the formation of the second low, indicating increased buying pressure and a potential reversal. By the end of this article, you'll understand how to identify w pattern in stocks and m chart pattern and incorporate them into your own trading strategy. One such pattern that has gained prominence is the. Frequently surfacing on charts as a bullish reversal pattern, adept traders survey this figure to pinpoint the emergence of upward potential. The script also calculates the percentage difference between the current low and the previous high, displaying this value on the chart when the pattern is detected. Web the w trading pattern embodies a cornerstone concept in market analysis, spotlighting. If in doubt, simply eyeball the chart and see how price is moving. It consists of two equal lows, creating a symmetrical pattern. To spot the w pattern, traders should first identify a strong downtrend in the forex market. The structure of w pattern: Web overview of w bottoms and tops chart patterns. By the end of this article, you'll understand how to identify w pattern in stocks and m chart pattern and incorporate them into your own trading strategy. This first trend reversal is usually short in duration and does not last long and the price falls again. A w pattern is a charting pattern used in technical analysis that indicates a. This first trend reversal is usually short in duration and does not last long and the price falls again. Traders may use w bottoms and tops chart patterns as powerful indicators for buying and selling decisions. To spot the w pattern, traders should first identify a strong downtrend in the forex market. The script also calculates the percentage difference between. One such pattern that has gained prominence is the w pattern. This pattern signifies a reversal of a downtrend and often indicates a bullish trend reversal. A w pattern is a charting pattern used in technical analysis that indicates a bullish reversal. Web what is a w pattern? Web the w trading pattern is a reversal pattern used to identify. The renko charts must be in an uptrend. Web a w pattern is a double bottom chart pattern that has tall sides with a strong trend before and after the w on the chart. Traders look for a significant increase in trading volume during the formation of the second low, indicating increased buying pressure and a potential reversal. It resembles the letter ‘w’ due to its structure formed by two consecutive price declines and recoveries. The w chart pattern is a reversal pattern that is bullish as a downtrend holds support after the second test and rallies back higher. Web these patterns, aptly named the w pattern and m stock pattern, are classic chart formations that technical traders watch for. The world of trading is filled with patterns and signals that traders use to make informed decisions. It is characterized by its distinctive ‘w’ shape, formed by two troughs and a peak. The pattern starts emerging when the prices first jump off after the constant horizontal trend line of an asset. Web big w is a double bottom chart pattern with talls sides. A favorite of swing traders, the w pattern can be formed over a. How to spot a double bottom pattern in a w pattern chart. Web the w trading pattern is a reversal pattern used to identify changes in market trends. This pattern signifies a reversal of a downtrend and often indicates a bullish trend reversal. Web the w chart pattern is read as a bullish turnaround where prices are expected to increase after weeks or months of price decline. It consists of two equal lows, creating a symmetrical pattern.W Pattern Trading YouTube

W Trading Pattern A Comprehensive Guide BrokerExtra

Know the 3 Main Groups of Chart Patterns FX Access

W Pattern Double Bottom Is a Reliable Bullish Trading Signal

W Pattern Trading New Trader U

How to Trade Triangle Chart Patterns FX Access

W Pattern Trading vs. M Pattern Strategy Choose One or Use Both? • FX

Pattern Trading Unveiled Exploring M and W Pattern Trading

W Pattern Trading The Forex Geek

How Important are Chart Patterns in Forex? Forex Academy

The Double Bottom Pattern Occurs When The Price Of A Currency Pair Reaches A Low Point, Bounces Back Up, Dips Again To The Same Level,.

If It Is Moving From Bottom Left To.

This First Trend Reversal Is Usually Short In Duration And Does Not Last Long And The Price Falls Again.

The Double Bottom Pattern Always Follows A Major Or Minor Downtrend In A Particular.

Related Post: