Volatility Contraction Pattern

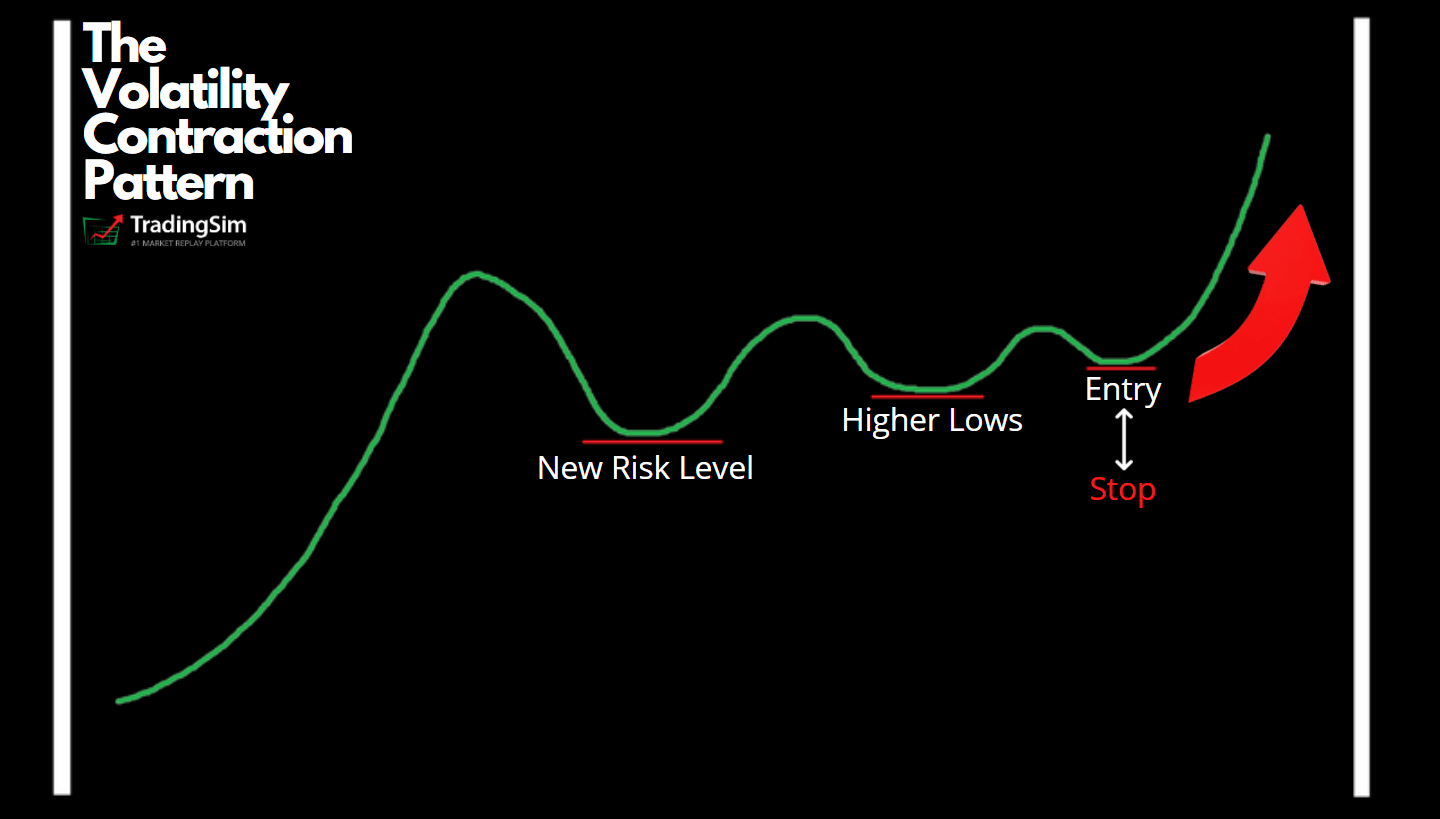

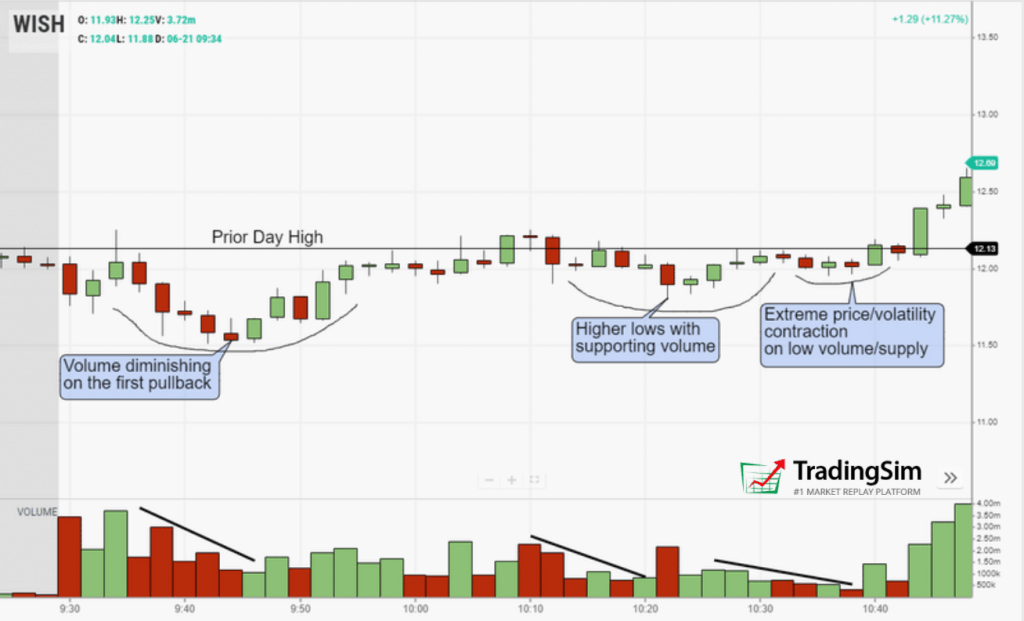

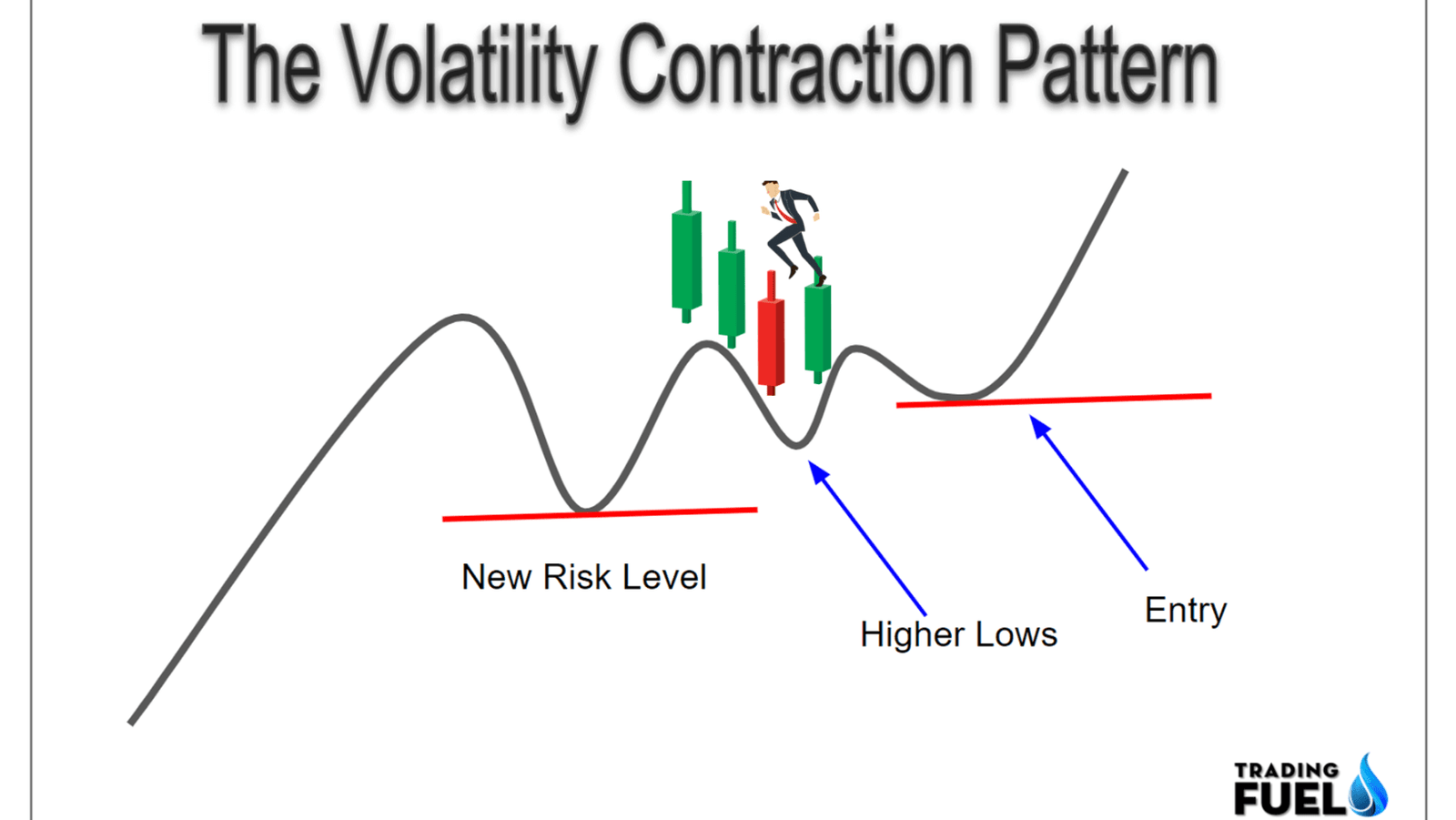

Volatility Contraction Pattern - Web volatility contraction patterns are often found in stocks before an explosive share price gain. In simplest words, prices of financial instruments form a contracted pattern when prices move sideways, volatility declines, and volume also decreases. Web a volatility contraction pattern is a pattern that forms during a consolidation period. And a lot of it. This means buyers should be active in the particular stock. For the volatility contraction pattern, the stock must be in demand. Web a volatility contraction pattern is a specific chart pattern within a consolidation period. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. Web the volatility contraction pattern (vcp) is a powerful trading pattern that has gained popularity and recognition among traders around the globe. To that point, there is no easier way to spot that demand than a. It's essentially a supply and demand characteristic that creates this chart pattern. Web the volatility contraction pattern (vcp) is a powerful trading pattern that has gained popularity and recognition among traders around the globe. Web volatility contraction patterns are often found in stocks before an explosive share price gain. And a lot of it. For a stock to create the proper setup for the vcp, there needs to be demand. Web what is the volatility contraction pattern? Web in technical analysis, the volatility contraction pattern (vcp) is a notable concept that traders use to identify potential breakouts in stock prices. In simplest words, prices of financial instruments form a contracted pattern when prices move sideways, volatility declines, and volume also decreases. This pattern emerges when there is a decrease in a stock’s volatility after a significant price move, typically following a period of consolidation. This means buyers should be active in the particular stock. Web a volatility contraction pattern is a specific chart pattern within a consolidation period. Web the volatility contraction pattern (vcp) is a powerful trading pattern that has gained popularity and recognition among traders around the globe. Web the vcp or volatility contraction pattern is a trading tactic coined by professional investor, mark minvervini. Web what is the volatility contraction pattern. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. It is essentially about appreciating price and volume action as supply diminishes during a price base. It's essentially a supply and demand characteristic that creates this chart pattern. Web what is the volatility contraction pattern (vcp pattern)? In simplest words, prices of financial instruments. For the volatility contraction pattern, the stock must be in demand. This tutorial covers the criteria of a vcp base, how to filte. Web volatility contraction patterns are often found in stocks before an explosive share price gain. Web what is the volatility contraction pattern (vcp pattern)? It is essentially about appreciating price and volume action as supply diminishes during. Web what is the volatility contraction pattern? In simplest words, prices of financial instruments form a contracted pattern when prices move sideways, volatility declines, and volume also decreases. For a stock to create the proper setup for the vcp, there needs to be demand. Web the volatility contraction pattern (vcp) is a powerful trading pattern that has gained popularity and. The main role of the vcp pattern is. Web what is the volatility contraction pattern? Web the volatility contraction pattern (vcp) is a powerful trading pattern that has gained popularity and recognition among traders around the globe. And a lot of it. Web a volatility contraction pattern (vcp) is a chart consolidation that tightens from left to right within a. It's essentially a supply and demand characteristic that creates this chart pattern. It is essentially about appreciating price and volume action as supply diminishes during a price base. Web what is the volatility contraction pattern? For the volatility contraction pattern, the stock must be in demand. Web a volatility contraction pattern (vcp) is a chart consolidation that tightens from left. This tutorial covers the criteria of a vcp base, how to filte. Web what is the volatility contraction pattern? It's essentially a supply and demand characteristic that creates this chart pattern. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. And a lot of it. This tutorial covers the criteria of a vcp base, how to filte. It's essentially a supply and demand characteristic that creates this chart pattern. This pattern emerges when there is a decrease in a stock’s volatility after a significant price move, typically following a period of consolidation. Web the vcp or volatility contraction pattern is a trading tactic coined by. Web a volatility contraction pattern (vcp) is a chart consolidation that tightens from left to right within a price base. Web what is the volatility contraction pattern (vcp pattern)? For the volatility contraction pattern, the stock must be in demand. When prices decrease in both volatility and volume, the price will form a contracted pattern which is better illustrated using. It is essentially about appreciating price and volume action as supply diminishes during a price base. Web a volatility contraction pattern is a pattern that forms during a consolidation period. This tutorial covers the criteria of a vcp base, how to filte. For a stock to create the proper setup for the vcp, there needs to be demand. The main. Web the volatility contraction pattern (vcp) is a powerful trading pattern that has gained popularity and recognition among traders around the globe. To that point, there is no easier way to spot that demand than a. This tutorial covers the criteria of a vcp base, how to filte. For a stock to create the proper setup for the vcp, there needs to be demand. Web volatility contraction patterns are often found in stocks before an explosive share price gain. Web what is the volatility contraction pattern? Web a volatility contraction pattern is a pattern that forms during a consolidation period. This pattern emerges when there is a decrease in a stock’s volatility after a significant price move, typically following a period of consolidation. This means buyers should be active in the particular stock. Web what is the volatility contraction pattern? The main role of the vcp pattern is. In simplest words, prices of financial instruments form a contracted pattern when prices move sideways, volatility declines, and volume also decreases. For the volatility contraction pattern, the stock must be in demand. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. Web the vcp or volatility contraction pattern is a trading tactic coined by professional investor, mark minvervini. Web in technical analysis, the volatility contraction pattern (vcp) is a notable concept that traders use to identify potential breakouts in stock prices.Understanding The Volatility Contraction Pattern TraderLion

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

How to Day Trade with the Volatility Contraction Pattern (VCP)?

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

The Volatility Contraction Pattern (VCP) How To Day Trade It TradingSim

The Volatility Contraction Pattern (VCP) How To Day Trade It TradingSim

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

How to Day Trade with the Volatility Contraction Pattern (VCP)?

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

It's Essentially A Supply And Demand Characteristic That Creates This Chart Pattern.

Web A Volatility Contraction Pattern (Vcp) Is A Chart Consolidation That Tightens From Left To Right Within A Price Base.

Web A Volatility Contraction Pattern Is A Specific Chart Pattern Within A Consolidation Period.

When Prices Decrease In Both Volatility And Volume, The Price Will Form A Contracted Pattern Which Is Better Illustrated Using A Bollinger Band Indicator.

Related Post: