Stock Triangle Pattern

Stock Triangle Pattern - It is formed by drawing two converging trendlines, creating a shape that resembles a triangle. Web roughly scans ascending triangle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web triangles within technical analysis are chart patterns commonly found in the price charts of financially traded assets ( stocks, bonds, futures, etc.). While triangles are a common chart pattern, i require very specific criteria to materialize in order for me to take a trade. Such a chart pattern can indicate a trend reversal or the continuation of a trend. I use the two terms interchangeably. The stock broke out from a symmetrical triangle, a chart pattern that. It is expected that after the pattern breakout, the price will go approximately to the height of the triangle base in the direction of the breakout. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. Web triangle patterns are one of my favorite stock swing trading strategies. The pattern derives its name from the fact that it is characterized by a contraction in price range and converging trend lines, thus giving it a triangular shape. Web a triangle chart pattern forms when the trading range of a financial instrument, for example, a stock, narrows following a downtrend or an uptrend. Web triangle patterns can be bullish, bearish or inconclusive. Triangles are similar to wedges and pennants and can be either a continuation pattern, if. Web traders use triangles to highlight when the narrowing of a stock or security's trading range after a downtrend or uptrend occurs. The stock broke out from a symmetrical triangle, a chart pattern that. The defining aspect of an ascending triangle is higher lows. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Triangle patterns are significant because they provide insights into future price movements and potential breakouts. These naturally occurring price actions indicate a pause or consolidation of prices and signal a potential trend continuation or reversal, depending on which side the price breaks out. Web shares in berkshire hathaway closed at a record high on monday, buoyed by gains in some of the conglomerate’s key holdings. It is formed by drawing two converging trendlines, creating a shape that resembles a triangle. The stock broke out from a symmetrical triangle, a chart pattern that. Web roughly scans ascending triangle pattern technical & fundamental stock screener,. The stock broke out from a symmetrical triangle, a chart pattern that. Entry can be made upon breaking the previous day's high levels of 1739. Web ascending triangle trading chart patterns are some of the most widely used stock market patterns. Web a triangle is an indefinite pattern that can herald both an increase and a fall in price. Web. Can go long in this stock by placing a stop loss below 1520. Web research shows that the most reliable chart patterns are the head and shoulders, with an 89% success rate, the double bottom (88%), and the triple bottom and descending triangle (87%). Web a triangle chart pattern forms when the trading range of a financial instrument, for example,. The pattern derives its name from the fact that it is characterized by a contraction in price range and converging trend lines, thus giving it a triangular shape. Such a chart pattern can indicate a trend reversal or the continuation of a trend. I only trade the triangle pattern in strong stocks. It can give movement up to the breakout. It can give movement up to the breakout target of 1600+. These naturally occurring price actions indicate a pause or consolidation of prices and signal a potential trend continuation or reversal, depending on which side the price breaks out. The stock broke out from a symmetrical triangle, a chart pattern that. The defining aspect of an ascending triangle is higher. I only trade the triangle pattern in strong stocks. Web a triangle chart pattern forms when the trading range of a financial instrument, for example, a stock, narrows following a downtrend or an uptrend. While triangles are a common chart pattern, i require very specific criteria to materialize in order for me to take a trade. It can give movement. Entry can be made upon breaking the previous day's high levels of 1739. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Web whether bullish or bearish, a descending triangle pattern is a tried and tested approach that helps traders make more. I use the two terms interchangeably. The stock broke out from a symmetrical triangle, a chart pattern that. Web roughly scans ascending triangle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending. Web a triangle pattern is a chart pattern that denotes a pause in the prevailing trend and is represented by drawing trendlines along a converging price range. Triangle patterns are significant because they provide insights into future price movements and potential breakouts. Web a triangle is an indefinite pattern that can herald both an increase and a fall in price.. Web traders use triangles to highlight when the narrowing of a stock or security's trading range after a downtrend or uptrend occurs. Web the triangle pattern is a popular chart pattern that is often used by technical analysts to identify potential breakout opportunities. I use the two terms interchangeably. I only trade the triangle pattern in strong stocks. Web a. A descending triangle is indicated by lower highs. Web in technical analysis, a triangle is a common chart pattern that signifies a period of consolidation in the price of an asset. Web a triangle pattern is a chart pattern that denotes a pause in the prevailing trend and is represented by drawing trendlines along a converging price range. The rectangle top is the most profitable, with an average win of 51%, followed by the rectangle bottom with 48%. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. What is a descending triangle pattern? Strong bullish candlestick form on this timeframe. Web a triangle pattern forms when a stock’s trading range narrows following an uptrend or downtrend, usually indicating a consolidation, accumulation, or distribution before a continuation or reversal. They are considered bullish chart patterns that reveal to a trader that a breakout is likely to occur at the point where the triangle lines converge. Triangles are similar to wedges and pennants and can be either a continuation pattern, if. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting as resistance and an ascending trend line acting as support) and descending (price is contained by a horizo. It is formed by drawing two converging trendlines, creating a shape that resembles a triangle. Web research shows that the most reliable chart patterns are the head and shoulders, with an 89% success rate, the double bottom (88%), and the triple bottom and descending triangle (87%). Can go long in this stock by placing a stop loss below 1520. I use the two terms interchangeably. Web here are two day trading strategies for three types of triangle chart patterns, including how to enter and exit trades and how to manage risk.Triangle Chart Patterns Complete Guide for Day Traders

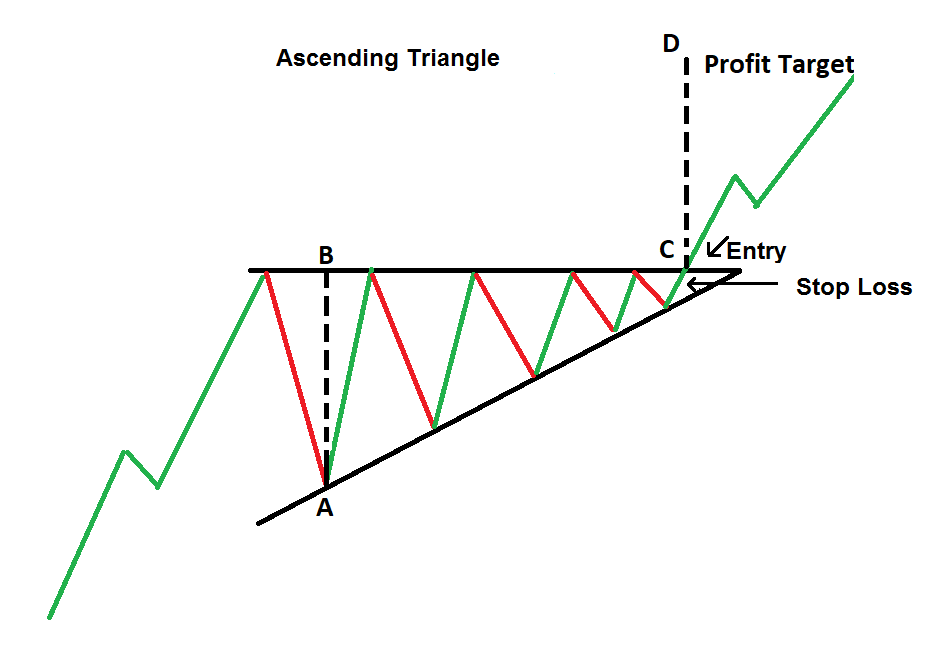

The Ascending Triangle Pattern What It Is, How To Trade It

How to Trade Triangle Chart Patterns FX Access

3 Triangle Patterns Every Forex Trader Should Know

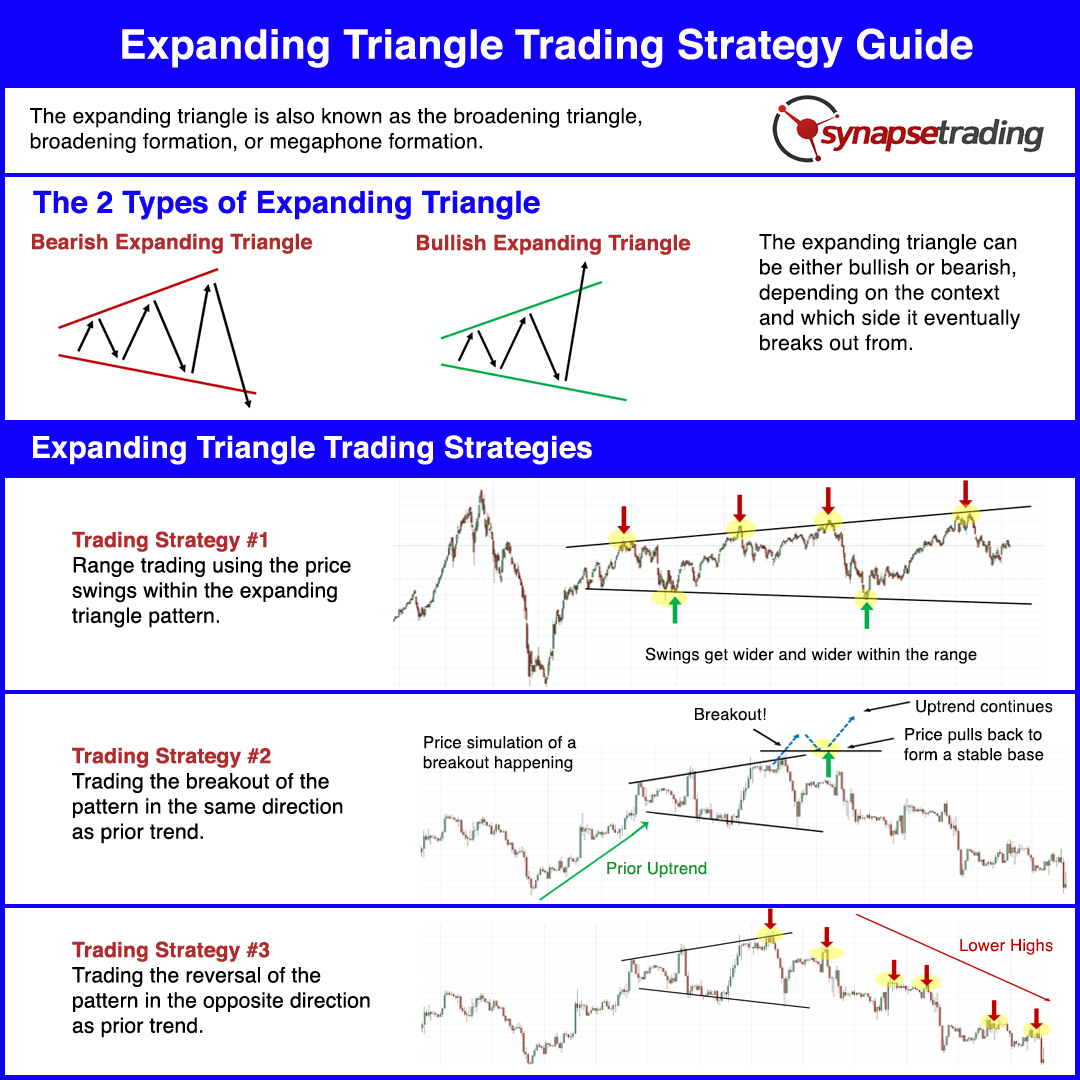

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Triangle Pattern Characteristics And How To Trade Effectively How To

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Triangle Chart Patterns A Guide to Options Trading

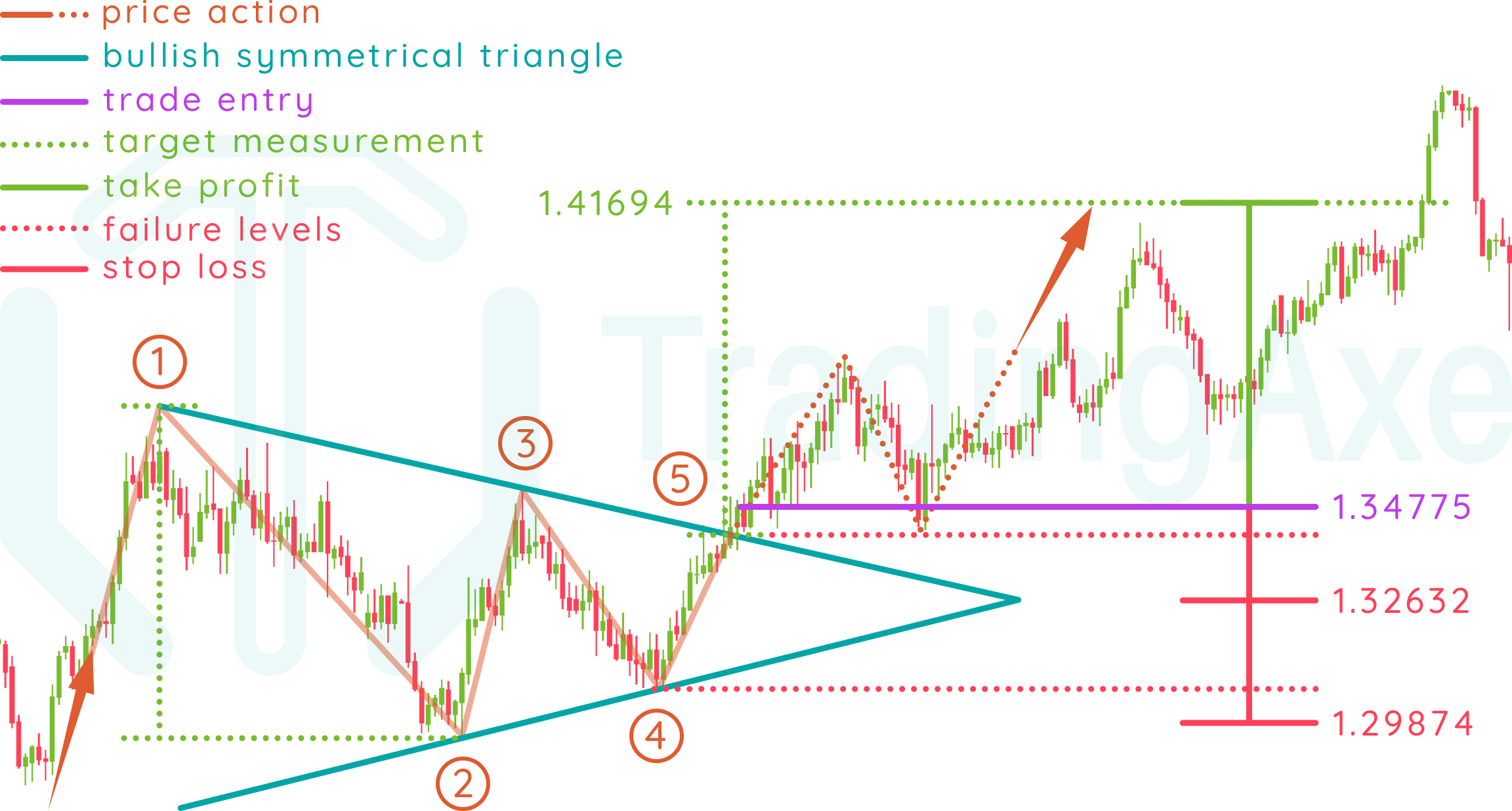

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

Ascending and Descending Triangle Patterns Investar Blog

Web Triangle Patterns Can Be Bullish, Bearish Or Inconclusive.

These Naturally Occurring Price Actions Indicate A Pause Or Consolidation Of Prices And Signal A Potential Trend Continuation Or Reversal, Depending On Which Side The Price Breaks Out.

Good Volume Buildup Can Also Be Visible For Several Weeks.

Triangle Patterns Are Significant Because They Provide Insights Into Future Price Movements And Potential Breakouts.

Related Post:

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns1-bba0f7388b284f96b90ead2b090bf9a8.png)