Inside Bar Candlestick Pattern

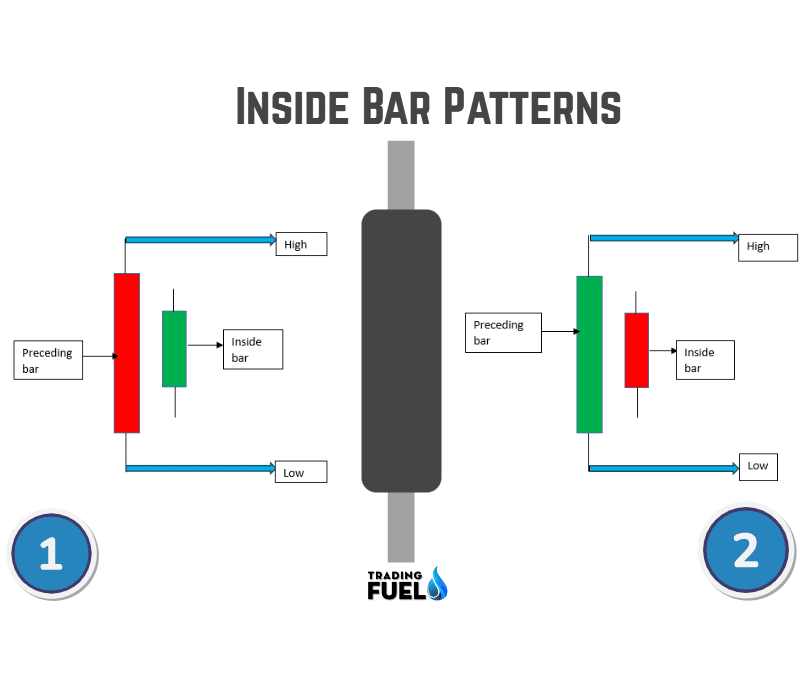

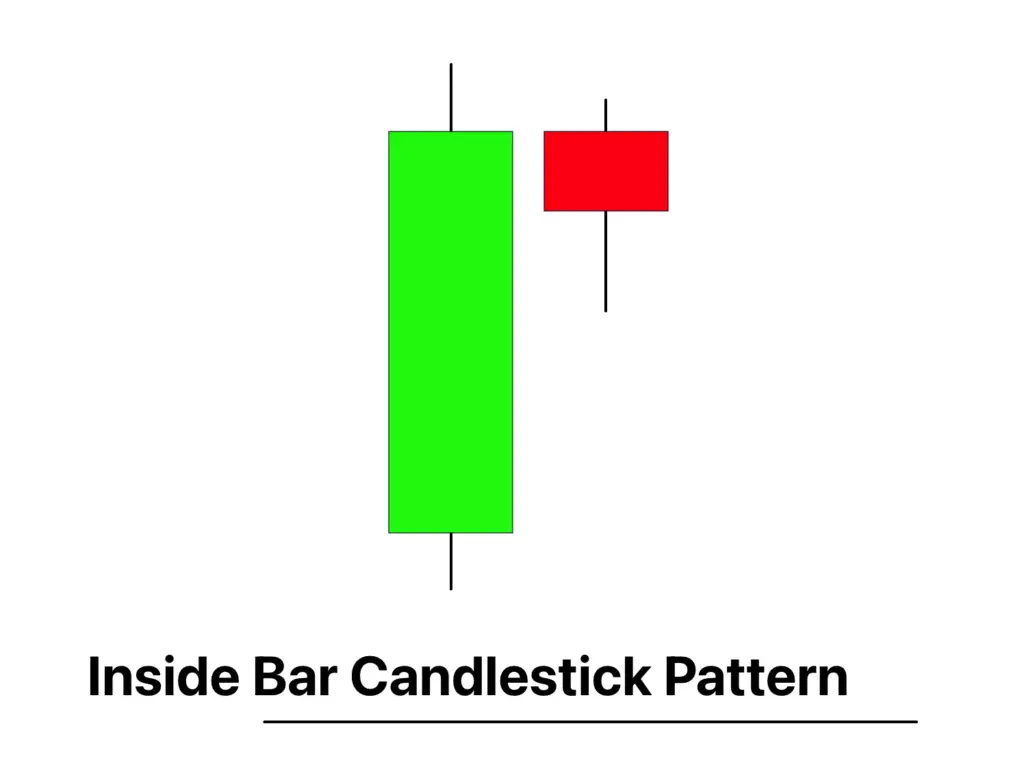

Inside Bar Candlestick Pattern - Web an inside day is a common technical chart pattern where the high and low of one day occur inside the high and low of the prior day. Web definition and identification. It can help you better time your entries with low risk. Web in this article, we will explore the various aspects of the inside bar pattern, from mother candle to bullish reversal, and share expert tips to enhance your trading performance with the profitable inside bar setup. An inside bar is a candle that’s “covered” by the prior candle. When the inside bar pattern develops at the end of a trend, it can signal a trend reversal. Web the inside bar candlestick pattern is a key formation in trading, highlighting moments of market consolidation and potential breakout points. Web the inside bar pattern is characterised by two consecutive candlesticks that often suggest a period of consolidation or indecision in the market. Inside days are thought to signal a continuation pattern. The high is lower than the previous bar's high, and the low is higher than the previous bar's low. Web the inside bar is a simple but powerful candlestick pattern. This pattern is comprised of two bars: The ‘inside bar’ is characterized by a bar or candle that is entirely ‘inside’ the range of the preceding one, whereas the ‘outside bar’ completely ‘overshadows’ or ‘engulfs’ the. It is the most widely used candlestick pattern and there is a clear logic behind this pattern. To trade inside bars, make sure that the smaller candle closes within the mother candle’s body. When this happens the previous bar is known as the mother bar. The script identifies inside bars on the chart and highlights them for easier. Web what is the inside bar candlestick pattern? An inside bar is a candle that’s “covered” by the prior candle. Web the inside bar is a two bar candlestick pattern, which indicates price consolidation. Breakout, trend continuation, and reversal strategies. Web the inside bar is a simple but powerful candlestick pattern. An inside bar is a candle that’s “covered” by the prior candle. Web in this article, we will explore the various aspects of the inside bar pattern, from mother candle to bullish reversal, and share expert tips to enhance your trading performance with. Breakout, trend continuation, and reversal strategies. The script identifies inside bars on the chart and highlights them for easier. You can use it to trade with the trend or, market reversals. Inside bars indicate a period of consolidation or indecision in the market, often preceding a breakout or reversal. Web the inside bar strategy is a candlestick pattern used to. In other words, the inside bar has a higher low and lower high than the previous bar. It’s a pattern that forms after a large move in the market and represents a period of consolidation. Web an inside bar candlestick pattern is notable for its simplicity and efficacy in various trading strategies. It is the most widely used candlestick pattern. Web the inside bar is a two bar candlestick pattern, which indicates price consolidation. In other words, the inside bar has a higher low and lower high than the previous bar. The ‘inside bar’ is characterized by a bar or candle that is entirely ‘inside’ the range of the preceding one, whereas the ‘outside bar’ completely ‘overshadows’ or ‘engulfs’ the.. Web what is the inside bar candlestick pattern? Web an inside bar candlestick pattern is notable for its simplicity and efficacy in various trading strategies. Web what is the inside bar pattern? This pattern is often interpreted as a period of consolidation before the price continues in the direction of the overall trend, or a potential reversal signal. Web what. It’s a pattern that forms after a large move in the market and represents a period of consolidation. Web inside and outside bars are two prevalent candlestick patterns in technical trading. Web in this article, we will explore the various aspects of the inside bar pattern, from mother candle to bullish reversal, and share expert tips to enhance your trading. Web the inside bar candlestick pattern is a key formation in trading, highlighting moments of market consolidation and potential breakout points. This pattern is comprised of two bars: Web the inside bar pattern is characterised by two consecutive candlesticks that often suggest a period of consolidation or indecision in the market. The high is lower than the previous bar's high,. Web the inside bar is a two bar candlestick pattern, which indicates price consolidation. Web an inside day is a common technical chart pattern where the high and low of one day occur inside the high and low of the prior day. As mentioned above, when trading the inside bar chart pattern you need to look for the mother bar. The script identifies inside bars on the chart and highlights them for easier. The ‘inside bar’ is characterized by a bar or candle that is entirely ‘inside’ the range of the preceding one, whereas the ‘outside bar’ completely ‘overshadows’ or ‘engulfs’ the. Web the inside bars candlestick pattern, an example of a bullish inside setup, can be leveraged in three. You can use it to trade with the trend or, market reversals. An inside bar is a candle that’s “covered” by the prior candle. As the name suggests, an inside bar chart pattern engulfs the inside of a large candle, some call it a mother bar. Web what is the inside bar candlestick pattern? Web the inside bar is a. Web in this article, we will explore the various aspects of the inside bar pattern, from mother candle to bullish reversal, and share expert tips to enhance your trading performance with the profitable inside bar setup. Web an inside day is a common technical chart pattern where the high and low of one day occur inside the high and low of the prior day. Web the inside bar candle pattern is not telling traders that the market is bidding price higher or lower but rather that the market is waiting before making the next big move in the asset. It is the most widely used candlestick pattern and there is a clear logic behind this pattern. You can use it to trade with the trend or, market reversals. Web what is the inside bar pattern? As mentioned above, when trading the inside bar chart pattern you need to look for the mother bar or candle, followed by the smaller candle, called the baby bar. When the inside bar pattern develops at the end of a trend, it can signal a trend reversal. To trade inside bars, make sure that the smaller candle closes within the mother candle’s body. Inside bars vary in size and range of the candle body, with the smaller variants showing an indecisive market. Breakout, trend continuation, and reversal strategies. The high is lower than the previous bar's high, and the low is higher than the previous bar's low. In order to confirm this pattern you need to see a candle on the chart, which is fully contained within the previous bar. Web the inside bar is a simple but powerful candlestick pattern. This pattern is comprised of two bars: Inside bars indicate a period of consolidation or indecision in the market, often preceding a breakout or reversal.Learn Inside Bar. Candlestick Pattern You Must Know (trading basics

InSide Bar Pattern Candlestick Patterns By Abhijit Zingade YouTube

The inside bar candlestick pattern Pro Trading School

Inside Bar Candle Trade Setup Trading Fuel Research Lab

Inside Bar Pattern Explained Trading Heroes

Inside Bar Candlestick Pattern 📉📉📉 for GLOBALPRIMEGER30 by AnonimFXRO

Inside Bar Candlestick Pattern PDF Guide Trading PDF

How to Trade Inside Bar Candlestick Patterns Trading charts, Forex

Best Inside Bar Trading Strategy Pro Trading School

Inside Candlestick Pattern

The ‘Inside Bar’ Is Characterized By A Bar Or Candle That Is Entirely ‘Inside’ The Range Of The Preceding One, Whereas The ‘Outside Bar’ Completely ‘Overshadows’ Or ‘Engulfs’ The.

Web The Inside Bar Strategy Is A Candlestick Pattern Used To Time Entries With Low Risk.

Web The Inside Bars Candlestick Pattern, An Example Of A Bullish Inside Setup, Can Be Leveraged In Three Primary Ways:

This Pattern Is Often Interpreted As A Period Of Consolidation Before The Price Continues In The Direction Of The Overall Trend, Or A Potential Reversal Signal.

Related Post: