Hammer Candle Pattern

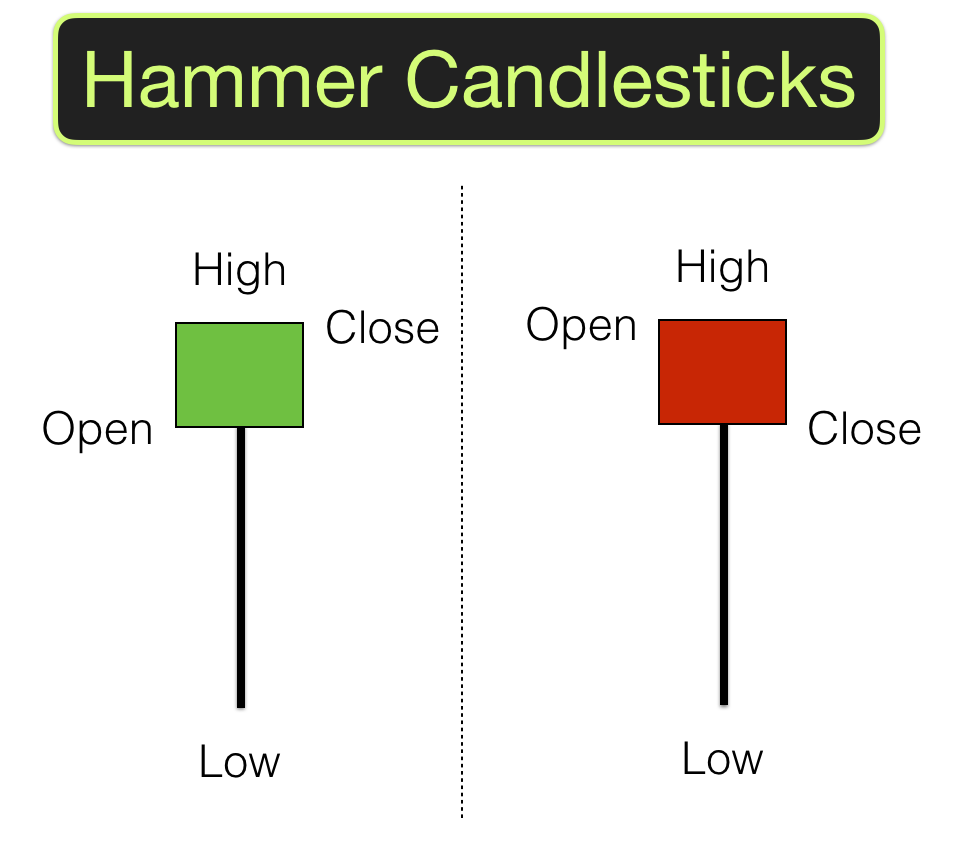

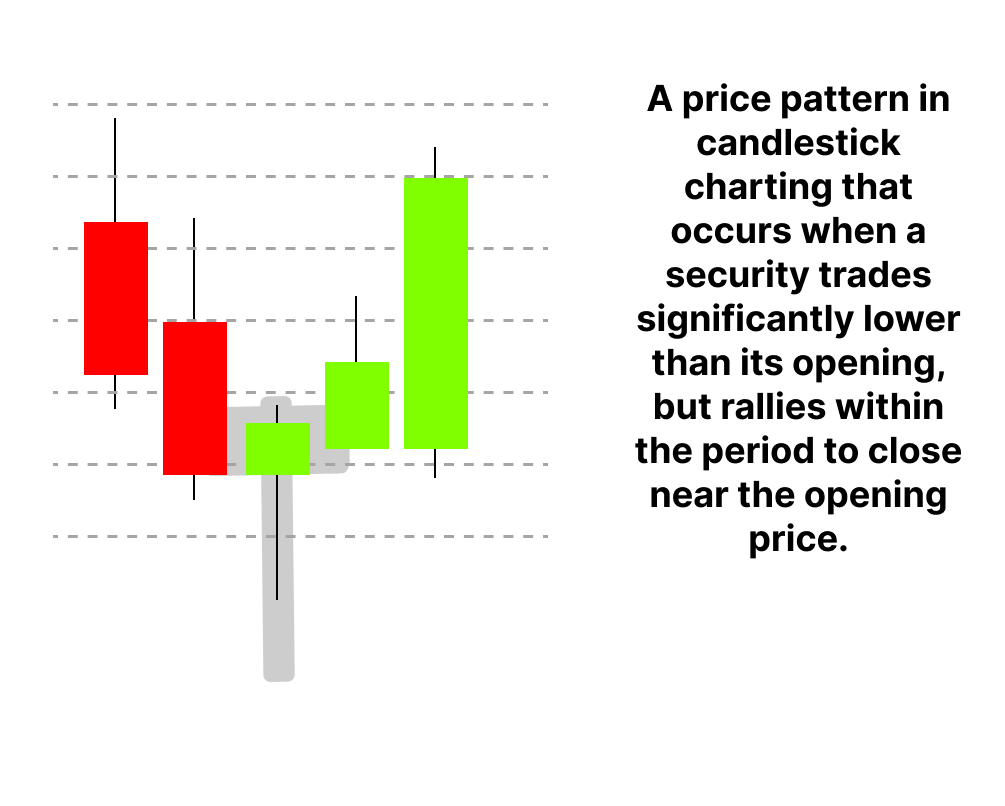

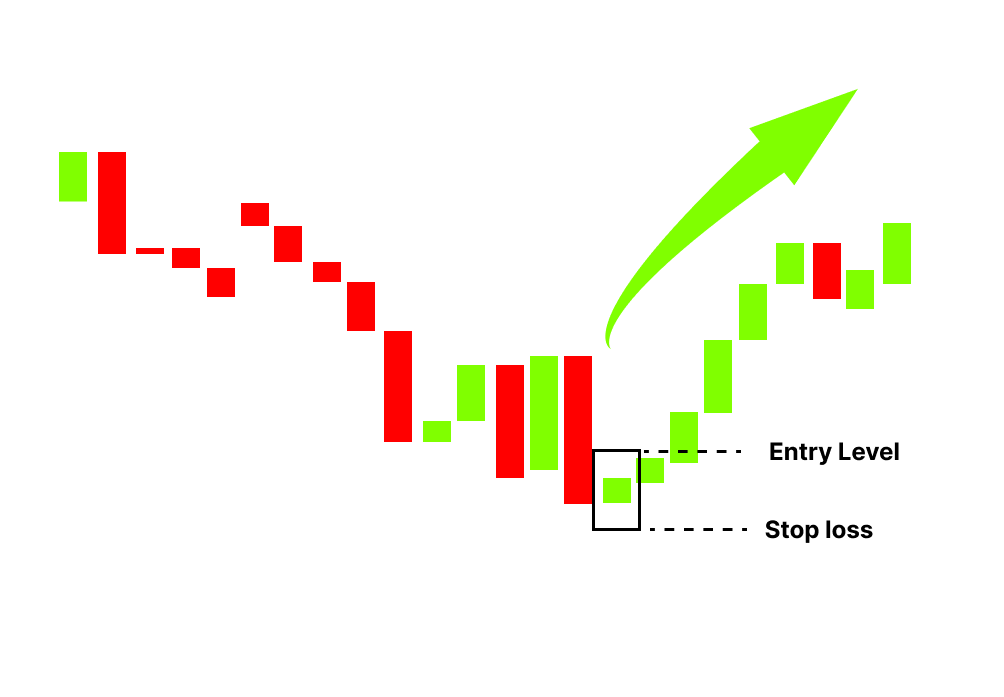

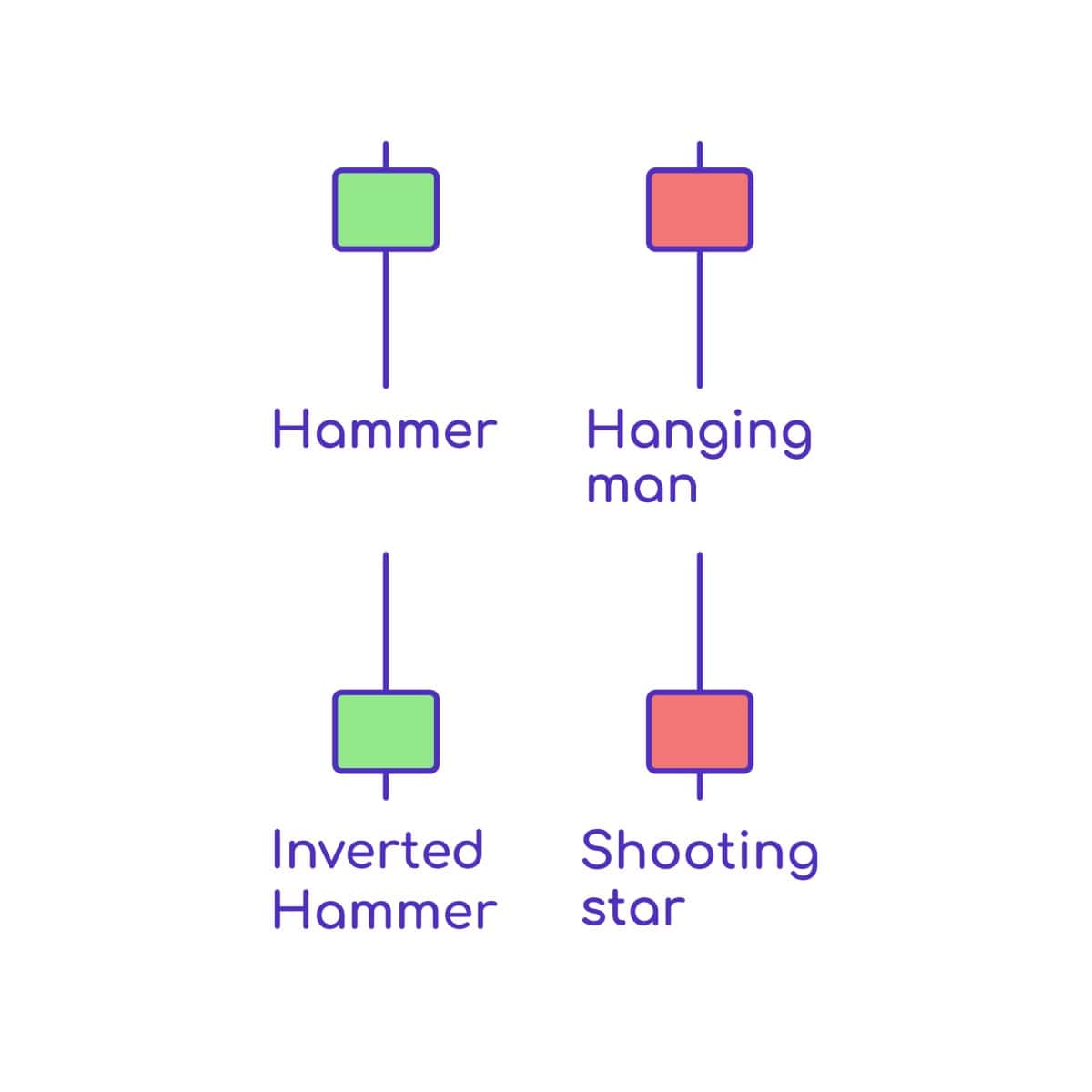

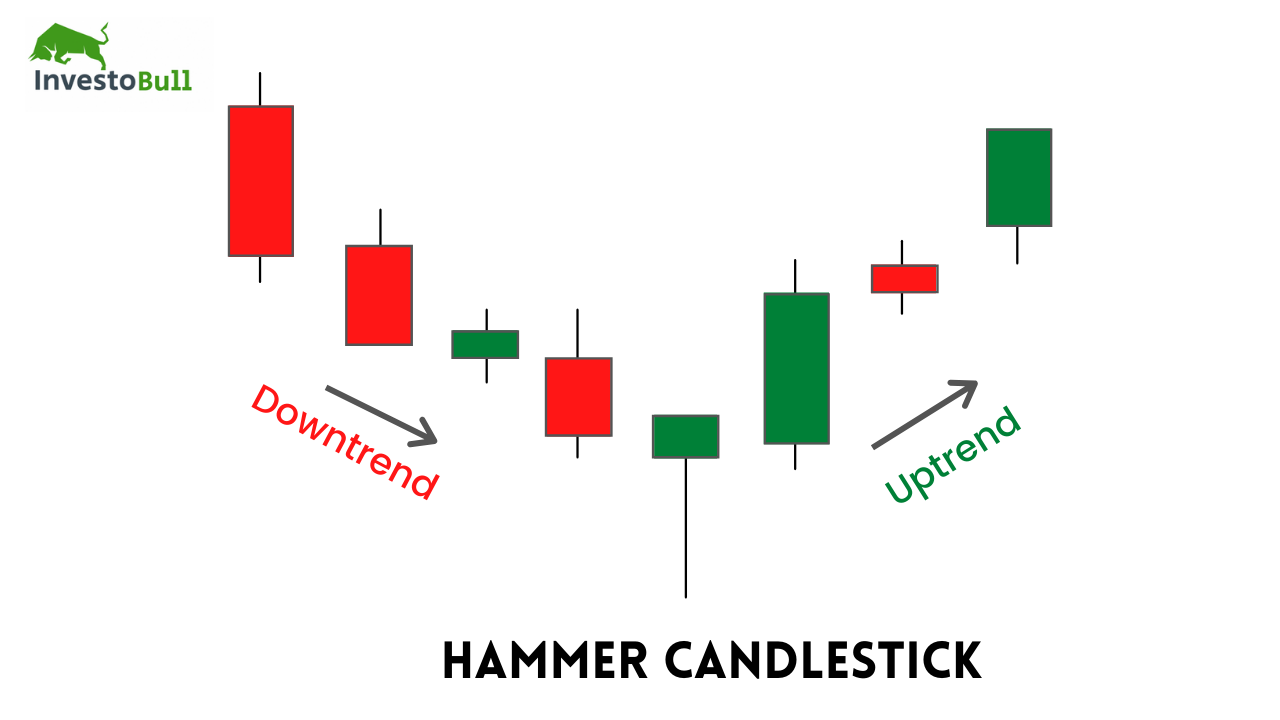

Hammer Candle Pattern - Web understanding hammer chart and the technique to trade it. The hammer helps traders visualize where support and demand are located. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Web apr 23, 2023 updated may 3, 2023. Hammer candlestick indicates reversal of bearish trend and helps traders to find a buy position at the end of bearish trend. This wick or shadow shows the lowest and highest market price during a specific period. Mysz have been struggling lately and have lost 11.1% over the past week. Web hammer candlestick patterns occur when the price of an asset falls to levels that are far below the opening price of the trading period before rallying back to recover some (or all) of those losses as the charting period completes. Hammer tied for second place and said this experience opened so many doors for her future career in the culinary arts. Ucf alumna sammy hammer, 24, competes in food network’s spring baking championship: It is often referred to as a bullish pin bar, or bullish rejection candle. Occurrence after bearish price movement. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. A minor difference between the opening and closing prices forms a small. However, a hammer chart pattern was formed in its last trading session, which could mean that the stock found support with bulls being able to counteract the bears. The hammer signals that price may be about to make a reversal back higher after a recent swing lower. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. It is the line that extends above and below the candle’s body. The hammer helps traders visualize where support and demand are located. Web understanding hammer chart and the technique to trade it. Web apr 23, 2023 updated may 3, 2023. Web hammer candlestick pattern consists of a single candlestick & its name is derived from its shape like a hammer having long wick at bottom and a little body at top. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. Web understanding hammer chart and the technique to trade it. The hammer helps traders. It is the line that extends above and below the candle’s body. Web the hammer candlestick pattern is a bullish reversal pattern used by traders to signal a potential change in a downward price trend. Most price action traders use this candlestick to identify reliable price reversal points. Our guide includes expert trading tips and examples. Learn what it is,. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Mysz have been struggling lately and have lost 11.1% over the past week. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening. Web hammer heads gift & smoke shop, llc has been set up 7/18/2012 in state fl. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. It signals that the market is about to change trend direction and advance to new heights. The hammer helps traders visualize where support and demand are. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. The hammer signals that price may be about to make a reversal back higher after a recent swing lower. Meanwhile you can send your letters to 824 e eau gallie blvd, indian harbor. This pattern typically appears when a downward trend in stock prices. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. This is one of the popular price patterns in candlestick charting. Learn what it is, how to identify it, and how to use it for. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. It is often referred to as a bullish pin bar, or bullish rejection candle. Web a longer body indicates selling pressure or stronger buying. This is one of the popular price patterns in candlestick charting. The current status of the business. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Occurrence after bearish price movement. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. The wick or shadow is another crucial part of the candlestick chart pattern. Web the hammer pattern is one of the first candlestick formations. It is often referred to as a bullish pin bar, or bullish rejection candle. Ucf alumna sammy hammer, 24, competes in food network’s spring baking championship: Irrespective of the colour of the body, both examples in the photo above are hammers. Web the hammer candlestick is one of the most popular candlestick patterns traders use to make sense of a. Ucf alumna sammy hammer, 24, competes in food network’s spring baking championship: Irrespective of the colour of the body, both examples in the photo above are hammers. Web understanding hammer chart and the technique to trade it. This shows a hammering out of a base and reversal setup. Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Shares of my size, inc. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Web a longer body indicates selling pressure or stronger buying. Most price action traders use this candlestick to identify reliable price reversal points. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. Occurrence after bearish price movement. They consist of small to medium size lower shadows, a real body, and little to no upper wick. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. This is one of the popular price patterns in candlestick charting. The hammer helps traders visualize where support and demand are located. However, a hammer chart pattern was formed in its last trading session, which could mean that the stock found support with bulls being able to counteract the bears.Candlestick Hammer And Shooting Star Bruin Blog

Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

Hammer Candlestick Patterns (Types, Strategies & Examples)

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

The Hammer Candlestick Pattern Identifying Price Reversals

Hammer Candlestick Pattern Trading Guide

Hammer Candlestick Pattern Trading Guide

Candlestick Patterns The Definitive Guide (2021)

What is Hammer Candlestick Pattern June 2024

Web Learn How To Use The Hammer Candlestick Pattern To Spot A Bullish Reversal In The Markets.

Web A Hammer Candlestick Is A Chart Formation That Signals A Potential Bullish Reversal After A Downtrend, Identifiable By Its Small Body And Long Lower Wick.

Web The Hammer Candlestick Is One Of The Most Popular Candlestick Patterns Traders Use To Make Sense Of A Securities’ Price Action.

Hammer Candlestick Indicates Reversal Of Bearish Trend And Helps Traders To Find A Buy Position At The End Of Bearish Trend.

Related Post: