Expanding Wedge Pattern

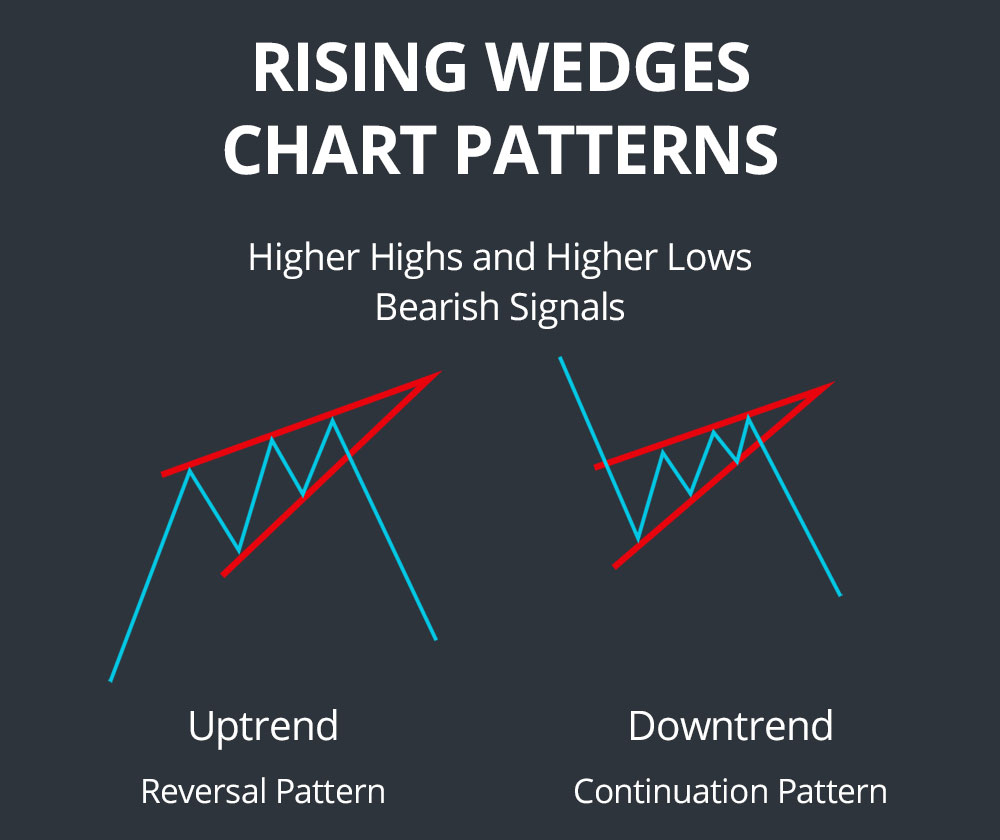

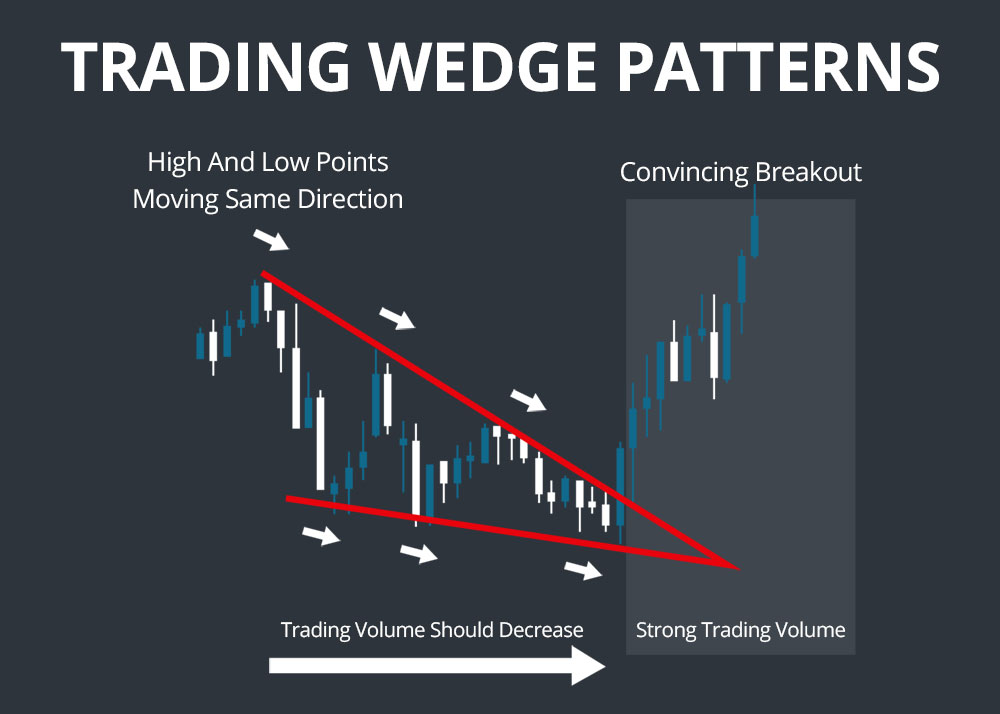

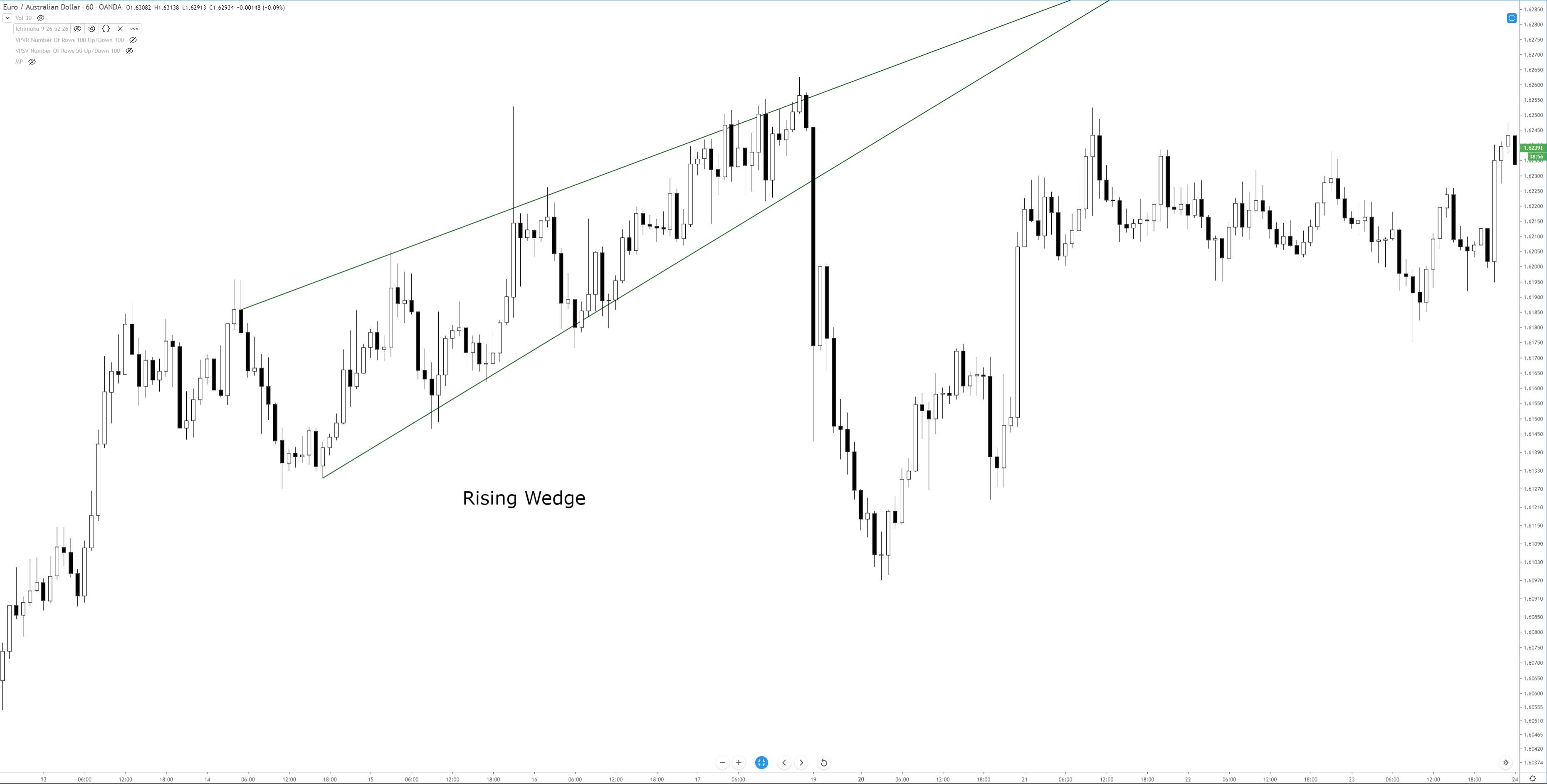

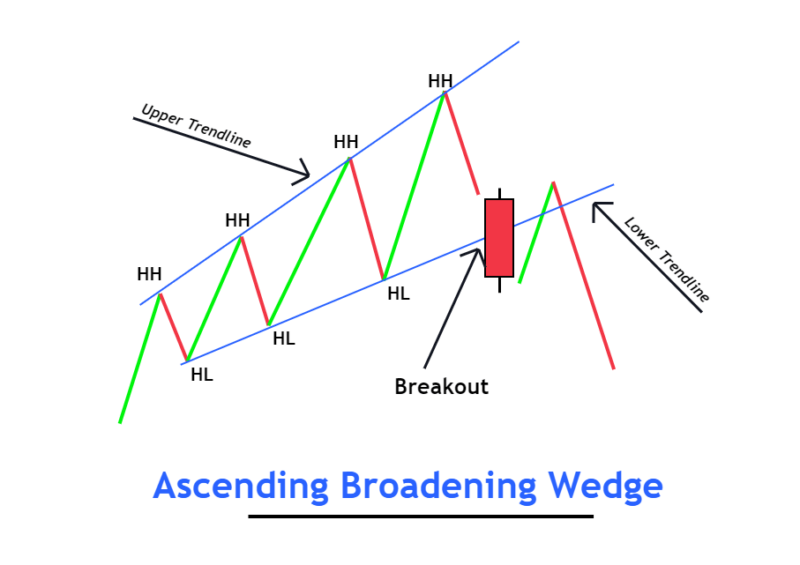

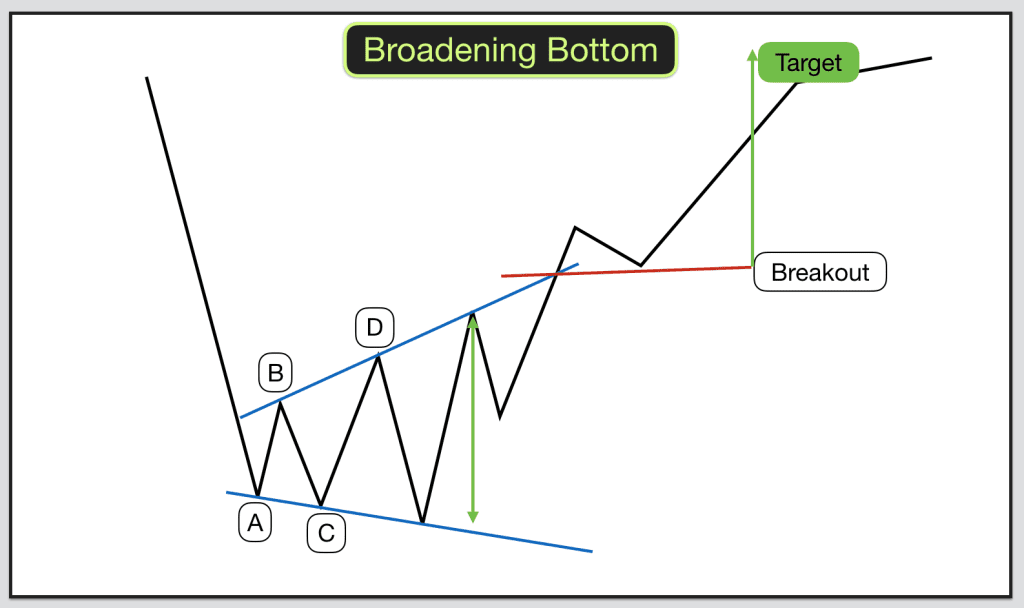

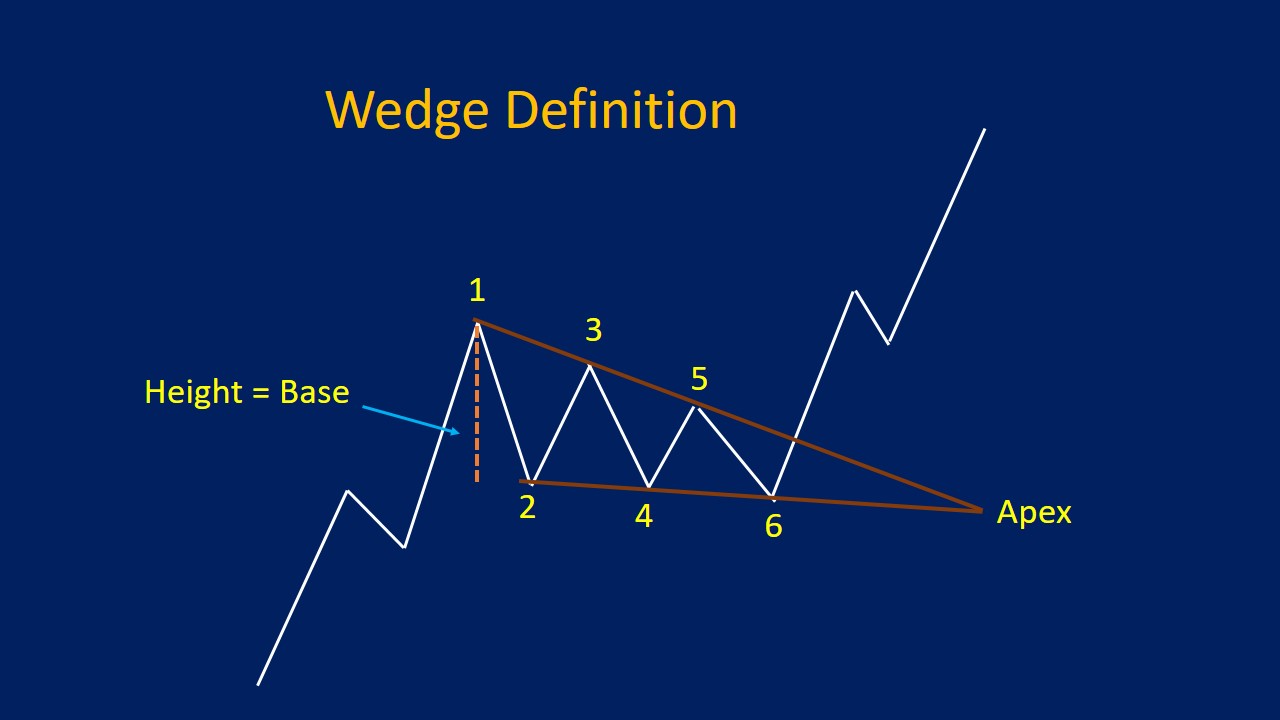

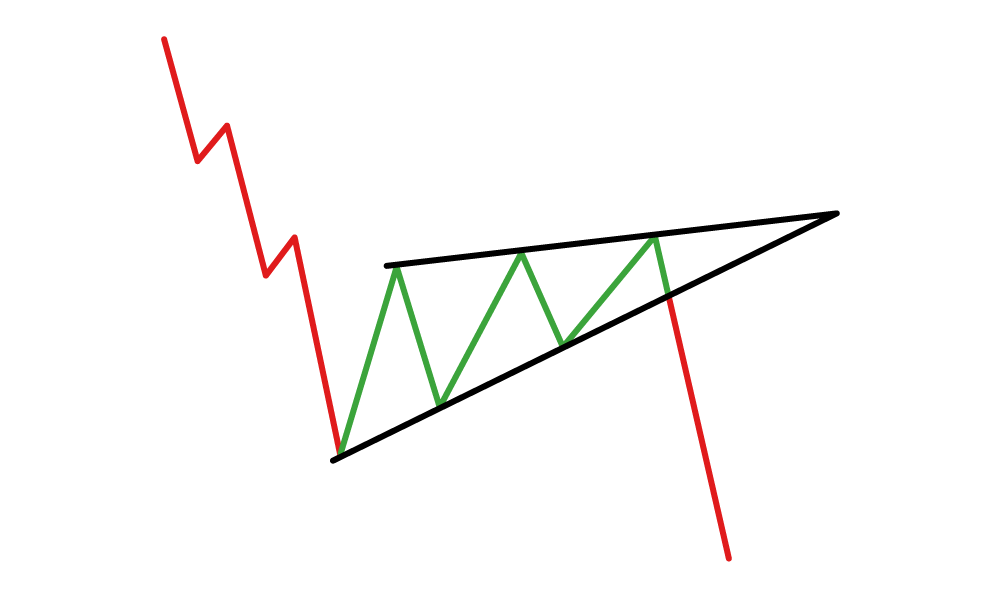

Expanding Wedge Pattern - It’s formed by drawing trend lines that connect a series of sequentially higher peaks and higher troughs for an uptrend, or lower peaks and lower troughs for a downtrend. The ascending broadening wedge pattern occurs in price charts, particularly for stocks, commodities, and forex trades. Today, we will uncover the hidden gem of trading patterns: Web in a wedge chart pattern, two trend lines converge. It is represented by two lines, one ascending and one descending, that diverge from each other. It is characterized by a narrowing range of price with higher highs and higher lows, both. Web a broadening formation is a price chart pattern identified by technical analysts. Web wedges can offer an invaluable early warning sign of a price reversal or continuation. Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and used alongside other components to a successful trading strategy. Web what is an ascending broadening wedge pattern? It is represented by two lines, one ascending and one descending, that diverge from each other. Read this article for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. It is formed by two diverging bullish lines. As previously stated, during an uptrend, falling wedge patterns can indicate a potential increase, while rising wedge patterns can signal a potential decrease. Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and used alongside other components to a successful trading strategy. I have used the techniques for improving it and trading strategies from my personal practice. It is characterized by two diverging trendlines, with the upper trendline sloping upwards and the lower trendline sloping downwards. Confirm the pattern, find an entry point, and make a profit with the right strategy. Learn how to exploit bullish and bearish wedge patterns correctly. Wedges signal a pause in the current trend. Web a wedge is a price pattern marked by converging trend lines on a price chart. If you draw lines along with the highs and lows, then the two lines will form an imaginary angle that will narrow over time. This graphical configuration was developed by thomas bulkowski and first mentioned in the book encyclopedia of chart patterns. When you. Volume often increases as the pattern develops, adding another layer of complexity to your analysis. It is formed by two diverging bullish lines. Web a wedge is a technical analysis pattern used in financial markets, illustrating an asset's narrowing price movement over time. Web there are 6 broadening wedge patterns that we can separately identify on our charts and each. If you draw lines along with the highs and lows, then the two lines will form an imaginary angle that will narrow over time. Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish reversal. Unlike other chart patterns like triangles, the lines here move away from each other. It is formed by. It is represented by two lines, one ascending and one descending, that diverge from each other. Web the key characteristic of the broadening wedge pattern is the expanding price fluctuation, which is indicative of increasing price volatility. Web a wedge pattern is a chart pattern that signals a future reversal or continuation of the trend. It’s formed by drawing trend. Web a wedge is a technical analysis pattern used in financial markets, illustrating an asset's narrowing price movement over time. Unlike other chart patterns like triangles, the lines here move away from each other. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. Read this article for performance statistics and trading. Web what is an ascending broadening wedge pattern? Web there are 6 broadening wedge patterns that we can separately identify on our charts and each provide a good risk and reward potential trade setup when carefully selected and used alongside other components to a successful trading strategy. It is identified by connecting a series of highs and lows on a. It is identified by connecting a series of highs and lows on a price chart, forming converging trend lines, often resembling a 'wedge'. Learn all about the falling wedge pattern and rising wedge pattern here, including how to spot them, how to trade them and more. It is characterized by two diverging trendlines, with the upper trendline sloping upwards and. Web a broadening formation is a price chart pattern identified by technical analysts. These patterns can be extremely difficult to recognize and interpret on a chart since they bear much resemblance to triangle patterns and do not always form cleanly. As previously stated, during an uptrend, falling wedge patterns can indicate a potential increase, while rising wedge patterns can signal. It is formed by two diverging bullish lines. Confirm the pattern, find an entry point, and make a profit with the right strategy. If you draw lines along with the highs and lows, then the two lines will form an imaginary angle that will narrow over time. Read this article for performance statistics and trading tactics, written by internationally known. As previously stated, during an uptrend, falling wedge patterns can indicate a potential increase, while rising wedge patterns can signal a potential decrease. It means that the magnitude of price movement within the wedge pattern is decreasing. It is characterized by increasing price volatility and diagrammed as two diverging trend lines, one rising. Volume often increases as the pattern develops,. As previously stated, during an uptrend, falling wedge patterns can indicate a potential increase, while rising wedge patterns can signal a potential decrease. It is characterized by two diverging trendlines, with the upper trendline sloping upwards and the lower trendline sloping downwards. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. Web an ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern). Web wedges can offer an invaluable early warning sign of a price reversal or continuation. Web a wedge pattern is a popular trading chart pattern that indicates possible price direction changes or continuations. It is characterized by a narrowing range of price with higher highs and higher lows, both. Web prepare long orders on bullish falling wedges or expanding wedge patterns trading after prices break through the upper slanted resistance. Web differentiate wedges from triangles and flags to predict upcoming trends correctly. It’s formed by drawing trend lines that connect a series of sequentially higher peaks and higher troughs for an uptrend, or lower peaks and lower troughs for a downtrend. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. It is identified by connecting a series of highs and lows on a price chart, forming converging trend lines, often resembling a 'wedge'. Web in a wedge chart pattern, two trend lines converge. It is formed by two diverging bullish lines. Web a broadening formation is a price chart pattern identified by technical analysts. Wedges signal a pause in the current trend.Rising Expanding Wedge Pattern

Wedge Patterns How Stock Traders Can Find and Trade These Setups

How to trade Wedges Broadening Wedges and Broadening Patterns

Wedge Patterns How Stock Traders Can Find and Trade These Setups

Rising Expanding Wedge Pattern

Ascending Broadening Wedge Definition ForexBee

Widening Wedge Chart Pattern

How to trade Wedges Broadening Wedges and Broadening Patterns

Wedge Pattern Rising & Falling Wedges, Plus Examples

Rising Expanding Wedge Pattern

This Graphical Configuration Was Developed By Thomas Bulkowski And First Mentioned In The Book Encyclopedia Of Chart Patterns.

Web A Technical Chart Pattern Recognized By Analysts, Known As A Broadening Formation Or Megaphone Pattern, Is Characterized By Expanding Price Fluctuation.

Web There Are Two Falling And Two Rising Wedge Patterns On The Chart.

Web The Emergence Of Artificial Intelligence (Ai) And, More Particularly, Machine Learning (Ml), Has Had A Significant Impact On Engineering And The Fundamental Sciences, Resulting In Advances In Various Fields.

Related Post: