Bearish Candle Patterns

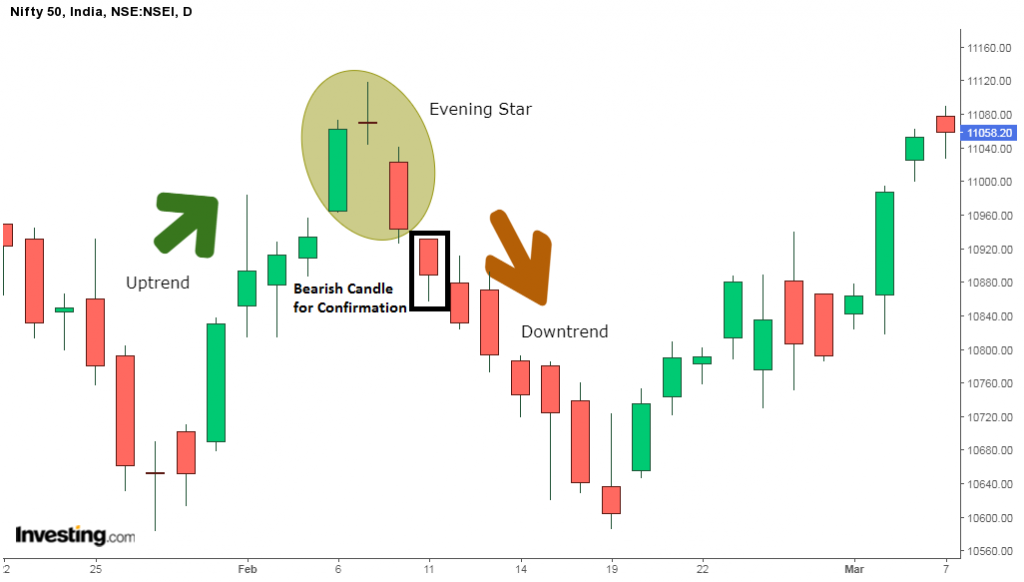

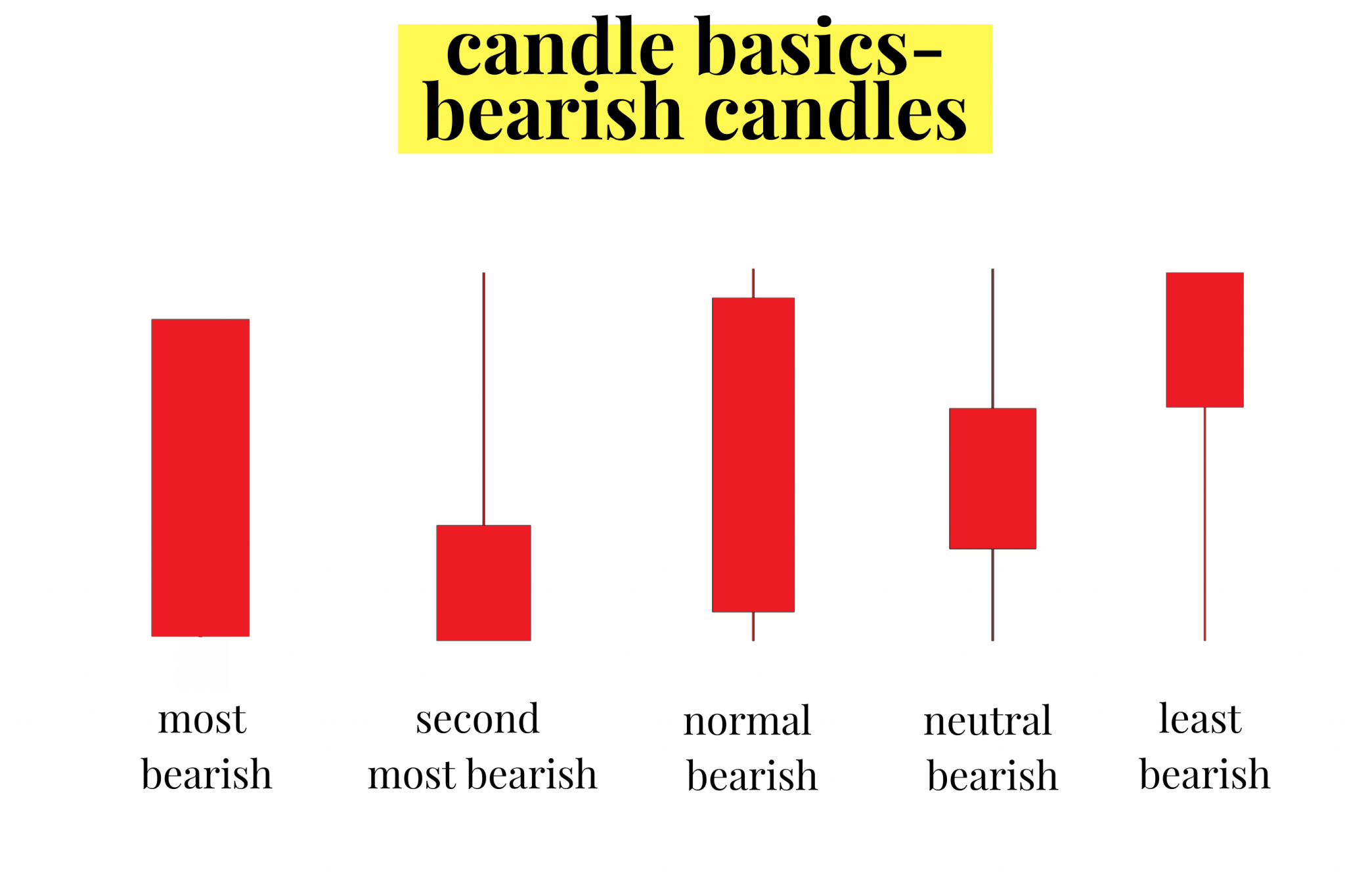

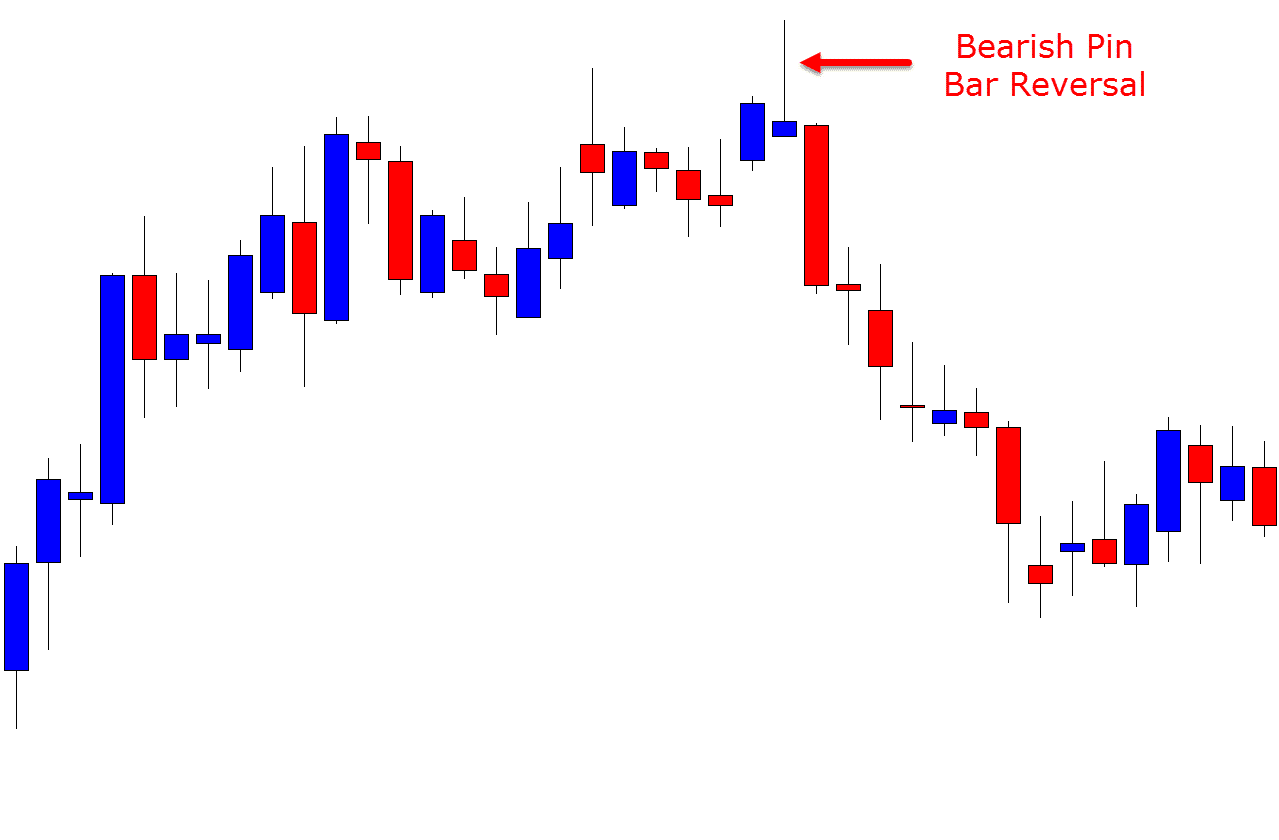

Bearish Candle Patterns - They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web bearish candlestick patterns are either a single or a combination of candlesticks that usually point to lower price movements in a stock. Web a bearish engulfing candlestick pattern comprises of two candles and appears during an uptrend. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. A tweezers topping pattern occurs when the highs of two candlesticks occur at almost exactly the same level following an advance. Web let us look at the top 5 bearish candlestick patterns: Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. When the market or a stock is bearish, the price goes down. The second day’s candle would completely engulf the body of the first day’s candle. Comprising two consecutive candles, the pattern features a. The script also calculates the percentage difference between the current low and the previous high, displaying this value on the chart when the pattern is detected. Web some common bearish patterns include the bearish engulfing pattern, dark cloud cover, and evening star candlestick, among others. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Being a trend reversal pattern, it occurs when the prices are in an uptrend but buyers are losing momentum. These patterns indicate that sellers may soon take control, pushing the. Web bearish candlestick patterns are either a single or a combination of candlesticks that usually point to lower price movements in a stock. At no.1 we are going with a bearish reversal pattern very useful and easy to spot in the bullish markets. Web 📚 three black crows is a bearish candlestick pattern used to predict the reversal of a current uptrend. And a bearish reversal has higher probability reversing an uptrend. Frequently asked questions (faqs) what are bearish candlestick patterns? Web learn about all the trading candlestick patterns that exist: Channel resistance (taken from the high of 5,325) and a 1.272% fibonacci. Hedera’s [hbar] recent reversal from the $0.06 support level set the stage for the bulls to end their bearish rally. The first candle is bullish in the pattern, signaling the continuation of the underlying uptrend. Remember, the trend. Web bearish candlestick patterns. These patterns typically consist of a combination of candles with specific formations, each indicating a shift in market dynamics from buying to selling pressure. Their uniqueness and combinations hint at what may happen in the future. Strong candlestick patterns are at least 3 times as likely to resolve in the indicated direction (greater than or equal. Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. A bullish reversal holds more weight in a downtrend. The default value is 20. A tweezers topping pattern occurs when the highs of two candlesticks occur at almost exactly the same level following an advance. This is a bearish reversal signal and was. Candlestick patterns are technical trading formations that help visualize the price movement of a liquid asset (stocks, fx, futures, etc.). Web bearish candlestick patterns are chart formations that signal a potential downtrend or reversal in the market. Being a trend reversal pattern, it occurs when the prices are in an uptrend but buyers are losing momentum. A breakout pierces the. Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). Web this strategy utilizes bollinger bands and engulfing candle patterns to generate trading signals. Web 5 powerful bearish candlestick patterns. The “flag” is made up of candles with lower highs and lower lows that take place between two strictly parallel trend lines; Web hbar’s. Web learn about all the trading candlestick patterns that exist: Web the s&p 500 gapped lower on wednesday and ended the session at lows, forming what many candlestick enthusiasts would refer to as an ‘evening star candlestick pattern’. Web discover what a bearish candlestick patterns is, examples, understand technical analysis, interpreting charts and identity market trends. Web hbar’s long/short ratio. The first candle is bullish in the pattern, signaling the continuation of the underlying uptrend. Web bearish candlestick patterns are either a single or a combination of candlesticks that usually point to lower price movements in a stock. The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong. Their uniqueness and. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web bearish candlestick patterns. Web 5 powerful bearish candlestick patterns. How can you tell if a candle is bearish? Web a candle pattern is best read by analyzing whether it’s bullish, bearish, or neutral (indecision). As the name suggests, it is a bearish engulfing pattern that occurs at the top of an uptrend. Watching a candlestick pattern form can be time consuming and irritating. These patterns typically consist of a combination of candles with specific formations, each indicating a shift in market dynamics from buying to selling pressure. Sure, it is doable, but it requires. Web each candlestick tells a unique story. Remember, the trend preceding the reversal dictates its potential: The most reliable japanese candlestick chart patterns — three bullish and five bearish patterns — are rated as strong. Bullish, bearish, reversal, continuation and indecision with examples and explanation. Web bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Short sellers and put options buyers are riding those prices down. Hedera’s [hbar] recent reversal from the $0.06 support level set the stage for the bulls to end their bearish rally. Web the shooting star, hanging man pattern, and bearish engulfing are common bearish candles. Web bearish candlestick patterns typically tell us an exhaustion story — where bulls are giving up and bears are taking over. Web a few common bearish candlestick patterns include the bearish engulfing pattern, the evening star, and the shooting star. Check out or cheat sheet below and feel free to use it for your training! A breakout pierces the top line, resistance. Web hbar’s long/short ratio indicated a slight bullish edge. Many of these are reversal patterns. Many of these are reversal patterns. Web this strategy utilizes bollinger bands and engulfing candle patterns to generate trading signals. Frequently asked questions (faqs) what are bearish candlestick patterns? Web bearish candlestick patterns are either a single or a combination of candlesticks that usually point to lower price movements in a stock. A tweezers topping pattern occurs when the highs of two candlesticks occur at almost exactly the same level following an advance. At no.1 we are going with a bearish reversal pattern very useful and easy to spot in the bullish markets. The figure shows the bearish engulfing pattern.Bearish Candlestick Patterns Blogs By CA Rachana Ranade

"Bearish Candlestick Patterns for traders Ultimate Graphics" Poster

Bearish candlestick cheat sheet. Don’t to SAVE Candlesticks

5 Powerful Bearish Candlestick Patterns

Bearish Candlestick Patterns PDF Guide Free Download

bearishreversalcandlestickpatternsforexsignals Candlestick

Candlestick Patterns Explained New Trader U

Candlestick Patterns The Definitive Guide (2021)

What are Bearish Candlestick Patterns

Bearish Reversal Candlestick Patterns The Forex Geek

Many Of These Are Reversal Patterns.

Web A Bearish Engulfing Candlestick Pattern Comprises Of Two Candles And Appears During An Uptrend.

Web Each Candlestick Tells A Unique Story.

Web Bearish Candlestick Patterns Are Chart Formations That Signal A Potential Downtrend Or Reversal In The Market.

Related Post: